Welcome to this second blog in a series on the advantages of behavioral benchmarking and how it is a positive step forward for all.

In the first article, we examined how for most asset managers client experience (CX) has become THE reliable differentiator and why, to manage it, you need to measure it.

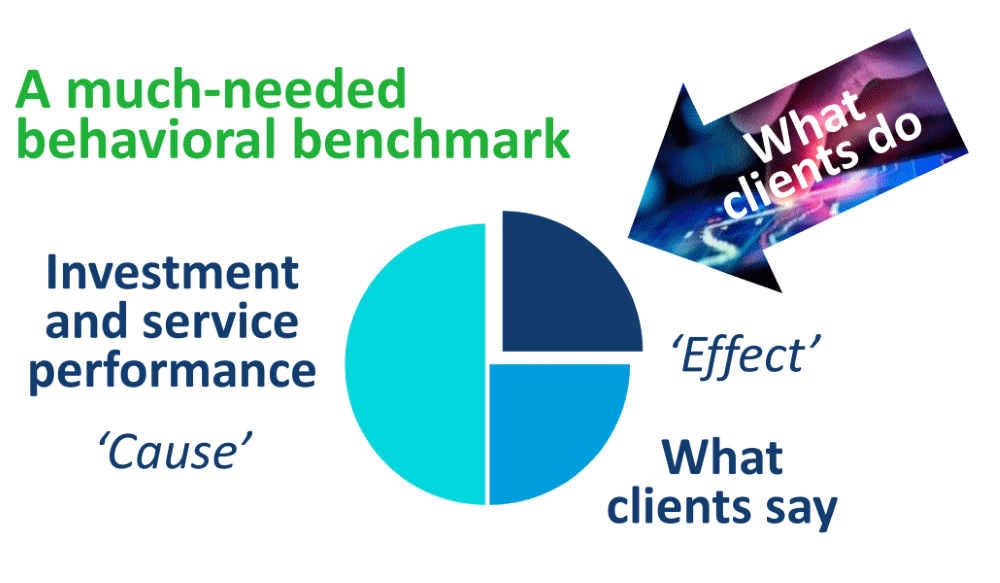

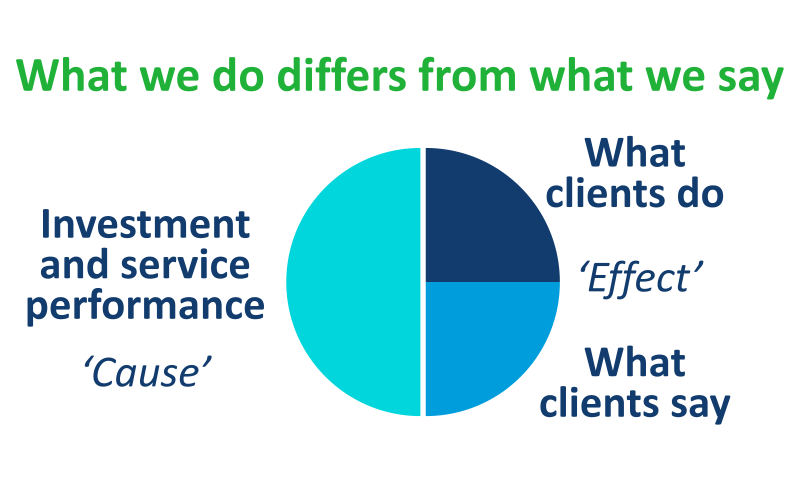

In this second blog, we explore how CX is an ‘effect’ you ‘cause’ that occurs in two ways – in what clients say (feedback), and what they do (behavior) – why you need to track both, and how firms at the leading edge are measuring client experience (CX).

To conclude the series, we discuss how you can leverage behavioral benchmarking to counteract the gaps and inaccuracies in feedback data, save time and effort, and alleviate clients ‘survey fatigue’.

CX is an ‘effect’ you ‘cause’

Before you can measure CX you must first know what it is.

In summary, it is an overall ‘effect’ you as a supplier ‘cause’ in your client. It is personal, subjective, open to influence, sometimes irrational, and subject to change as a result of any and every interaction they have with your firm.

CX operates on the emotional level where, when it comes to decisions about buying, staying and consuming more, a good experience is forgettable and only the extraordinary gets remembered, shared and discussed.

Your effect occurs in two ways.

You should measure both.

The effect you cause in your clients occurs in two ways – in what they say (feedback), and what they do (behavior). They are both observable and measurable.

Because of this, when it comes to making sense of your effect on clients you cannot rely solely on feedback data. For example, just because a client says “you’re good”, does not mean they think you’re the best and that they will pick you or stay with you. As we explain further below, if you do not measure both what they do as well as what they say you will create an incomplete and inaccurate picture of your CX, and risk creating a false sense of security and mis-allocating internal investment.

Measuring client experience

So how are leading asset managers measuring client experience?

In 2020, Accomplish worked with two groups of firms from the Asset Management CX Forum on how they measure client feedback and behavior. Here is what we found.

A suite of client feedback measures

Leading asset managers have developed programmes that measure a suite of feedback methods. Because of the importance of memory to the validity of feedback, in the best examples we encountered through our voice of the client research, firms were setting themselves different objectives for different timeframes.

In the real-time and day-to-day timeframe, these firms are catching clients in-the-moment to answer the tactical question: “how did we do?”

They are sampling clients about how successful or easy a process was for them. They are recognising patterns in feedback from routine interactions by using standardised CRM templates and voice-to-text technology. And they are monitoring engagement and support levels on social media and responding accordingly.

With this information, they are refining their personas, service offering(s) and marketing campaigns to ensure they stay aligned with clients as their needs evolve.

Over the quarterly and annual timeframe, it is too late to ask how you did because clients have forgotten, and you should have already fixed any issues. So, the leading asset managers have shifted the debate here to the strategic question of “could we do more?”

They are using relationship and service reviews, client satisfaction and advocacy methodologies, and industry-wide surveys to determine how to improve or change their products and services.

This suite of feedback measures protects their data against the inaccuracy of relying on a single sample or survey, and they are gaining rich insights into how it feels to be one of their clients.

However, their feedback data will be inaccurate due to the natural human bias against giving negative feedback – particularly in an industry known for being a village. It will also be incomplete because of human memory loss and because the investment industry’s reliance on feedback has inundated clients with requests and caused low response rates.

Feedback requests are essential, but they do interrupt clients while they are in the middle of something else, which is not always welcome and can create skews in the data if some clients start to ‘tune-out’ to them. The problem with this is that the words of a few may not represent the experience of all.

To gain a complete and accurate picture without further disrupting clients, the leading firms are also measuring behavior.

A much-needed Client Behavior Benchmark

Humans have a huge and complex repertoire of behaviors. To understand them, you need to compare several factors: their actual behavior vs. your expectation, how you stimulated it, and the environment in which it occurred. Accomplish is working with leading asset managers who are doing just this, giving them the power to measure what clients do as well as what they say.

Through an industry working group firms identified the moments that matter across the end-to-end institutional client journey. We defined the behaviors that indicate whether or not a touchpoint was successful. For each one, we then designed metrics that calculate the relationship between the asset manager’s actions and the clients’ response.

This created a taxonomy of the data you need to measure your behavioral effect on clients, and firms are using it to build the true story of their clients’ experiences. Because it is a standard taxonomy, they can compare their scores against each other. Lastly, because they have set-up the benchmark as a user-governed utility, they can do this anonymously and continually improve the underlying standard as they learn from its findings.

The resulting Client Behavior Benchmark fills a gap in the market and is the much-needed complement to existing measurements of client feedback:

- It is measurable over any timeframe

- It is unaffected by human biases of conflict-aversion and memory loss

- It causes zero disruption to clients

By pooling and sifting through everyone’s best ideas we have developed a best practice standard and, by structuring the resulting benchmark as an industry utility governed by its users, we have created the freedom for the standard to continue to evolve and refine as we learn more about the relative behaviors of institutional clients.

This has created a common language that firms can use to compare their performance at the key moments that matter, regardless of their technology stack and how they manage their CX on a day-to-day basis. Without this comparison, you simply will not know if feedback that says “you’re good” is good enough.

Achieving all this requires an investment in time, effort and a behavioral analytics capability. Now that a standard taxonomy of behavioral data exists, in the final blog in this series we will discuss the benefits of shortcutting that effort: pull the new standard off the shelf, establish or improve your CX measurement immediately, compare yourself against your peers, and then start predicting and influencing future behaviors to ensure their experience of your firm sticks in their memory.

Follow Accomplish on LinkedIn

As a discipline, CX is still in its infancy. This is particularly the case in the context of B2B asset management. Accomplish is on a mission to change this with new tools that help asset managers stand-out from the crowd through the experience they give their clients.

This was the second blog in a 3-part series on the advantages of behavioral benchmarking and how it fills the gap in the asset management industry’s toolbox. In our final article, we will discuss why behavioral benchmarking is a welcome development for all.

If you found this content interesting and would like to stay in touch with the topic, follow Accomplish on LinkedIn where we will post the last blog in the series and much more as we continue extending the leading edge of CX:

- Why asset managers should measure client experience

- How leading asset managers are measuring client experience

- Why asset managers should benchmark client behavior

1. FeldmanHall, et al, 2012. What we say and what we do: The relationship between real and hypothetical moral choices.

2. Tversky and Kahneman, 1974. Judgment under uncertainty – heuristics and biases.

3. Shafir, Simonson, and Tversky, 1993. Reason-based choice.

4. Cooper, Heron, and Heward, 2020. Applied behavior analysis.