Table of Contents

In brief

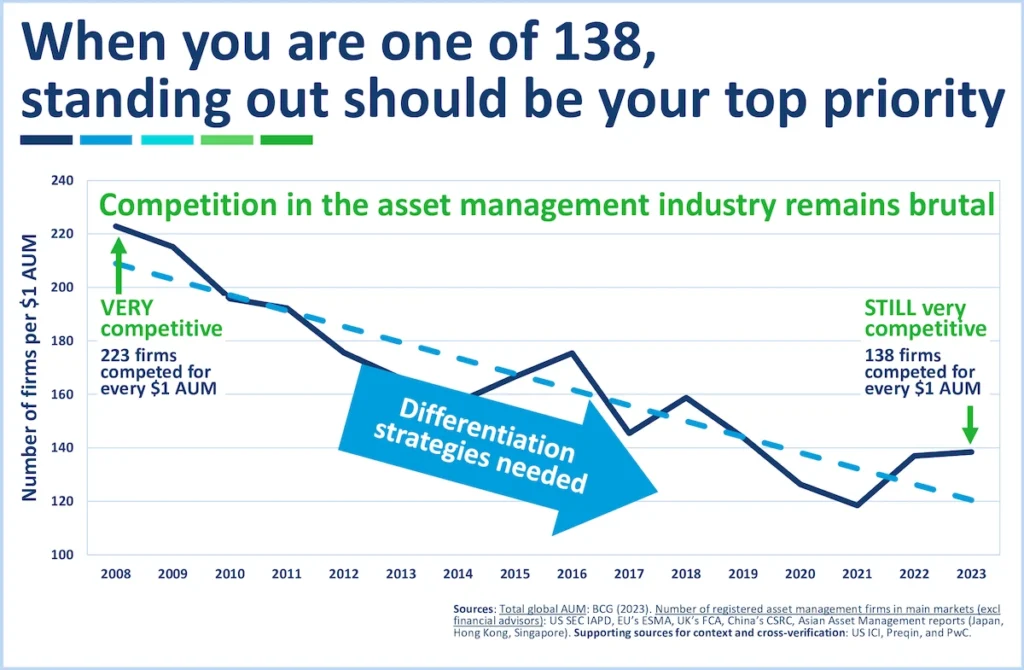

The asset management industry remains intensely competitive, and firms that fail to differentiate are disappearing. Previous differentiators have become ‘table stakes,’ requiring firms to adopt additional strategies. How to stand out? This article outlines 5 winning approaches for standing out, a decision-making framework, and implementation roadmaps. It also explains why one winning differentiator – AI-driven client experience (CX) – is set to become the next ‘table stake’. Contact us if you’d like to learn how to differentiate and future-proof your firm.

Despite consolidation, asset management remains intensely competitive

Intense industry competition – according to BCG, the industry saw a 3.5% compound annual growth rate (CAGR) in the five years to 2023. Meanwhile, according to Accomplish’s analysis above, the number of asset managers continued to shrink, with only 138 firms competing for every $1 AUM, compared to 223 in 2008.1 As a result, rivalry in the global asset management industry remains intense, with the market consolidation trendline providing clear evidence of what happens to those who fail to achieve a winning position.

Well-documented reasons – passive funds have substituted much of the active investment business’ market share, reducing the market’s ability to absorb oversupply. Specifically, between 2008 and 2023, 85% of active fund managers underperformed their benchmarks2 while (as a proxy) the proportion of US equity assets held in passive funds doubled from 25% to >50%.3 Meanwhile, economies of scale and regulatory barriers to entry have favored large firms.

How to stand out, strategically? When you are one of 138, standing out from the crowd should be your top priority. Merely doing the same as everyone else may not secure a long-term position. But how can you differentiate in a way that will provide a reliable source of long-term competitive advantage?

The future is safer for those who provide more than just ‘table stakes’

Common differentiation strategies evaluated – to understand what sets firms apart, we compared 8 differentiation strategies in the table below against 3 factors: client centricity, real value, and avoiding direct competition. These factors are the principles shared by each of the most cited and timeless theories of differentiation.4 Our goal was to identify the most reliable ways of standing out, and our findings indicate a new distinction between ‘table stakes’ (effectively the mandatory features of operating in the market) and ‘effective differentiation strategies’.

Common differentiation strategies in asset management

Category 1: Table stakes

1. Investment performance

How the strategy works

Example

Reliability, controllability, and predictability

Low – performance is hard to control and identify in advance; regulations limit marketing impact.

Criteria

2. Thought leadership and brand

How the strategy works

Example

Reliability, controllability, and predictability

Medium – builds trust, but many firms do this, making it hard to stand out. And uncontrollable events can conspire against you.

Criteria

3. Low-cost leadership

How the strategy works

Example

Reliability, controllability, and predictability

Medium – fee compression benefits investors, but this is a mature trend that does not have limitless potential for long-term differentiation.

Criteria

Category 2: Effective differentiation strategies

4. M&A and partnerships

How the strategy works

Example

Reliability, controllability, and predictability

Medium – diversify your product range and spread shared costs across a larger asset base. However, successful integration can be disruptive, and differentiation is not guaranteed.

Criteria

5. Specialize in a niche

How the strategy works

Example

Reliability, controllability, and predictability

High – avoids direct competition and builds authority in a specific area. The changeable nature of asset allocation adds risk.

Criteria

6. Proprietary technology and data-driven investing

How the strategy works

Example

Reliability, controllability, and predictability

High, but only if truly differentiated – many firms claim to do this, but only a few have a real edge.

Criteria

7. High-touch client experience (CX)

How the strategy works

Example

Reliability, controllability, and predictability

High – works well for institutions and HNW investors, since AI, it is no longer expensive or hard to offer at scale, and it is entirely under your control.

Criteria

8. Offer a complementary service

How the strategy works

Example

Reliability, controllability, and predictability

High – if you can solve a major client pain point.

Criteria

Table stakes are not enough – decades of over-supply of products into the global market has commoditized a lot of investment performance and forced most firms into becoming price-takers. This has reduced the reliability of previous differentiators like investment performance (#1) and pricing (#3) to the point that, alone, they are no longer enough. Similarly, while thought leadership and brand (#2) are essential, they are not reliable long-term differentiators because it is hard for clients to know who to listen to about the future and the nature of marketing is more short-term.

Effective differentiation strategies are deliberate choices to stand out, either about what you do or how you do it. Effective strategies relating to what you do include acquiring another firm to broaden your product range (#4), being a niche specialist (#5) or offering a complementary service (#8). How you do it includes proprietary investment decision-making technology (#6) or a high-touch CX (#7). Crucially, you can choose more than one because they cover these two categories.

Risks of not differentiating – before we explore which winning strategy is right for you, what will happen to those who fail to differentiate?

- Firms that place their reliance on investment performance risk further margin shrinkage if it goes wrong, followed by talent losses as key staff migrate to better-positioned firms that can cover higher fixed costs. This could risk client losses that, in turn, trigger strategy concentration and viability issues. For real-world examples, see Janus Capital or Legg Mason.

- Employees will face career shifts as demand rises for AI specialists in quantitative investing, data-driven risk analysts, and client experience professionals. These new career paths will be an opportunity for many, e.g. JPMorgan’s investment in AI training, but individuals who cannot adapt may face career stagnation or job loss.

How to stand out? Choosing the right differentiation strategies

Factors to consider – we then identify 7 factors: target market fit, competitive landscape, internal capabilities, investment and cost considerations, scalability, barriers to adoption, and key risks. For example, smaller firms may benefit from niche specialization (#5) or a high-touch client experience (#7). Technology-driven firms should consider proprietary AI & data (#6). While large institutions serving complex client needs can differentiate by getting even bigger (#4) and offering complementary services (#8).

CX: the ‘table stake’ of the future? The reason a high-touch CX is even a differentiation strategy relates to the fact that, until recently, it was not scalable, being largely driven by human interventions and customizations. This made it expensive and, therefore, a less common strategy. However, AI has changed this, making what is currently superior CX cheaper as AI increases your ability to manage complexity. Crucially, this strategy that applies to all asset classes and can be combined with other methods of differentiation. It is also entirely under your control, and clients know this, meaning that anything less than excellent CX will count against you in the future. As a result, we believe that AI-driven CX is set to become the next ‘table stake’: what currently classes as outperforming CX will become the norm. We recommend you factor this into your decision-making.

Effective differentiation strategies

4. M&A and partnerships

Start by evaluating your status quo

Target market fit

Competitive landscape

Internal capabilities

Investment and cost considerations

Scalability

Barriers to success

Key risks

5. Specialize in a niche

Start by evaluating your status quo

Target market fit

Competitive landscape

Internal capabilities

Investment and cost considerations

Scalability

Barriers to success

Key risks

6. Proprietary technology and data-driven investing

Start by evaluating your status quo

Target market fit

Competitive landscape

Internal capabilities

Investment and cost considerations

Scalability

Barriers to success

Key risks

7. High-touch client experience

Start by evaluating your status quo

Target market fit

Competitive landscape

Internal capabilities

Investment and cost considerations

Scalability

Barriers to success

Key risks

8. Offer a complementary service

Start by evaluating your status quo

Target market fit

Competitive landscape

Internal capabilities

Investment and cost considerations

Scalability

Barriers to success

Key risks

Implementation roadmaps

From strategy to action – once you’ve decided how to stand out, the next step is to turn your choice into action. This requires a clear implementation roadmap tailored to your strengths and market position.

To get you started, here are implementation roadmaps to tailor to your needs. They will help you assess your readiness for a particular strategy, conduct proper market research before you act, develop and implement the new capability, monitor its success, and optimize it over time.

Embark on a winning strategy today – by following these guides, you can move beyond recognizing differentiation as a necessity and start executing a winning strategy today. Why? Suppose your firm only provides ‘table stakes’ and has not already taken steps to differentiate. In that case, you may be relying on investment performance that is hard to control and identify in advance.

Strategy

4. M&A and partnerships

Step 1: Assess readiness

Step 2: Market research

1. Identify potential targets for strategic fit: long-term trends, regulatory considerations, and lessons learned from industry examples.

2. Assess cultural fit and identify key talent and their potential impact on succession plans.

3. Valuation and due diligence to avoid overpaying: financials, risk exposure (financial and regulatory), and operational synergies.

Step 3: Develop and implement

Step 4: Monitor and optimize

5. Specialize in a niche

Step 1: Assess readiness

Step 2: Market research

1. Assess each differentiation strategy as if you were entering a new market:

a. Who would be your new buyers, suppliers, regulators, and rivals?

b. How would these parties respond to your move?

c. How attractive would that future market be to you?

d. How would the move align with your brand?

Step 3: Develop and implement

Step 4: Monitor and optimize

6. Proprietary technology and data-driven investing

Step 1: Assess readiness

Step 2: Market research

1. Assess each differentiation strategy as if you were entering a new market:

a. Who would be your new buyers, suppliers, regulators, and rivals?

b. How would these parties respond to your move?

c. How attractive would that future market be to you?

d. How would the move align with your brand?

Step 3: Develop and implement

Step 4: Monitor and optimize

7. High-touch client experience

Step 1: Assess readiness

Step 2: Market research

1. Assess each differentiation strategy as if you were entering a new market:

a. Who would be your new buyers, suppliers, regulators, and rivals?

b. How would these parties respond to your move?

c. How attractive would that future market be to you?

d. How would the move align with your brand?

Step 3: Develop and implement

Step 4: Monitor and optimize

8. Offer a complementary service

Step 1: Assess readiness

Step 2: Market research

1. Assess each differentiation strategy as if you were entering a new market:

a. Who would be your new buyers, suppliers, regulators, and rivals?

b. How would these parties respond to your move?

c. How attractive would that future market be to you?

d. How would the move align with your brand?

Step 3: Develop and implement

Step 4: Monitor and optimize

Capitalize on Artefact’s and Accomplish’s strategic relationship

Asset management is a highly competitive and consolidating industry. This white paper has emphasized that standing out should be a top priority, demonstrated how it requires more than just ‘table stakes’, and examined 5 winning differentiation strategies.

How to stand out? Key themes have emerged:

- AI and technology are transforming both investment decision-making and high-touch CX, setting up AI-driven CX to become the next ‘table stake’.

- M&A and partnerships offer a path to growth, but only with careful integration planning and strategic fit.

- Niche specialization and complementary services provide focused value and reduce direct competition, strengthening client loyalty.

As firms look to the future, the asset managers who embrace strategic differentiation and execute effectively will lead the industry forward.

Adam Davis is a partner with Artefact – a world-leading data and AI consulting partner. Adam Grainger is the Head of Insights at Accomplish – a specialist provider of CX services to the asset management industry, including the CX Benchmark.

By leveraging Artefact’s and Accomplish’s capabilities, firms can turn these insights into action and establish themselves as leaders in a crowded market.

This paper is part of a series showcasing the uniqueness of our strategic relationship. We hope you found it useful; here is the complete series. Contact us if you’d like to learn how to differentiate and future-proof your firm.

- The Differentiation Challenge – five winning strategies for standing out in the crowded asset management market.

- The New Dawn – AI-driven CX is set to become the next ‘table stake’.

- The Vital Piece – a 5-Step CX Data Maturity Framework you can adapt to capitalize on AI-driven CX.

Footnotes

- Sources: Total global AUM: BCG (2023). Number of registered asset management firms in main markets (excl financial advisors): US SEC IAPD, EU’s ESMA, UK’s FCA, China’s CSRC, Asian Asset Management reports (Japan, Hong Kong, Singapore). Supporting sources for context and cross-verification: US ICI, Preqin, and PwC.

- https://www.spglobal.com/spdji/en/research-insights/spiva/

- https://www.morningstar.com/articles/1138751/passive-us-stock-funds-overtake-active-for-the-first-time

- The most cited and timeless theories of differentiation: Porter Michael E., (1985). Competitive Advantage: Creating and Sustaining Superior Performance. https://hbr.org/1985/05/how-competitive-forces-shape-strategy. W. Chan Kim and Renée Mauborgne’s, (2005). Blue Ocean Strategy. https://www.blueoceanstrategy.com Reeves, Rosser, (1961). Unique Selling Proposition (USP). https://www.inc.com/encyclopedia/unique-selling-proposition-usp.html Christensen, Clayton, (2003). Jobs-to-Be-Done Theory. https://www.christenseninstitute.org/jobs-to-be-done/ Pine & Gilmore, (1999). The Experience Economy. https://hbr.org/1998/07/welcome-to-the-experience-economy Ries & Trout, (1993). Positioning & The 22 Immutable Laws of Marketing. https://www.forbes.com/sites/forbescoachescouncil/2022/05/10/brand-positioning-strategy-what-it-is-and-why-its-important/ Ramadan et al (2016). Play Bigger: Category Design. https://www.playbigger.com/category-design