Key Experience Indicators (KXIs) – the missing piece of the puzzle

Asset managers are in a survival-of-the-fittest market

Traditional differentiators have become unreliable and bargaining power has shifted to clients. Client experience (CX) remains THE way to retain clients and minimise complexity and costs.

In an unfavourable macro-economic environment revenue retention takes precedent, which makes CX a top priority.

Client Experience (CX) is an overall impression

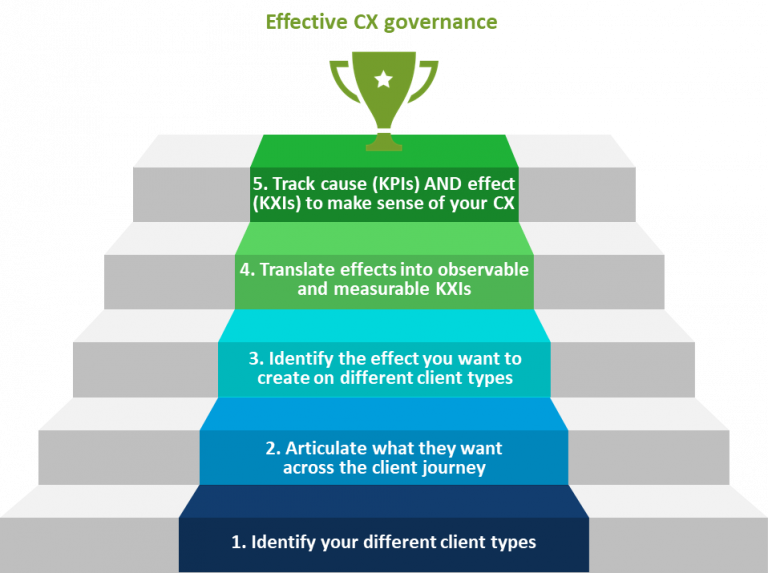

Effective CX governance will make sense of the experience you have given your clients by measuring actual observable effects (KXIs) and comparing them the causes (key performance indicators).

This research solves the problem.

CX is your client’s overall impression of you and it informs their decisions to buy, stay, and consume more of your services. It is personal, subjective, open to influence, and subject to change. It can be irrational.

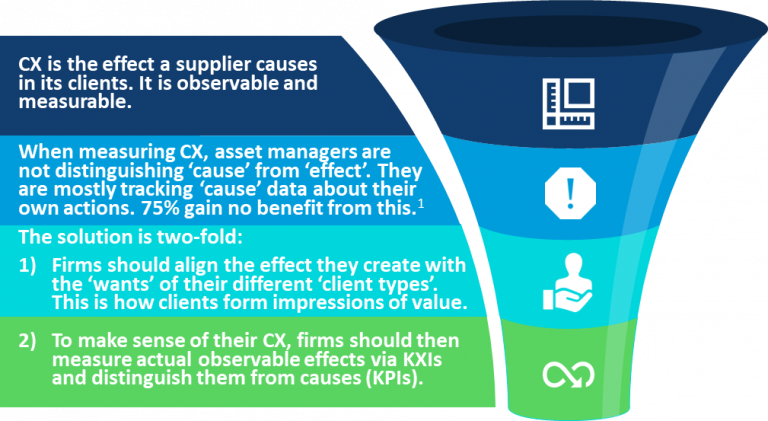

It is an effect in a client that a supplier causes, and it is observable and measurable.

Every direct and indirect interaction counts. From the moment a prospect becomes aware of you, through selection and onboarding, to every post-sale interaction until offboarding, when the client becomes a prospect again.

Key Experience Indicators (KXIs)

When measuring CX, asset managers are not distinguishing ‘cause’ from ‘effect’. They are mostly tracking ‘cause’ data about their own actions. 75% gain no benefit from this.

The solution is two-fold:

- Firms should align the effect they create with the ‘wants’ of their different ‘client types’. This is how clients form impressions of value.

- To make sense of their CX, firms should then measure actual observable effects via KXIs and distinguish them from causes (KPIs).

Using CX for your commercial advantage

In brief, asset managers should:

- Identify your different client types.

- Articulate what they want across the client journey.

- Identify the effect you want to create on different client types.

- Translate effects into observable and measurable KXIs.

- Track cause (KPIs) AND effect (KXIs) to make sense of your CX.

We save the detailed proposals for our member firms who can login here and find the full report in their ‘Premium Research’ section.

The missing piece of the puzzle

Our research included identifying the essential design principles of any CX measurement system. To check the strength of our proposal, we assessed it against these principles. We also included in this assessment the data from our industry survey and a case study from the leading edge of CX Governance in asset management. The key finding was that despite CX being an effect that is observable and measurable distinguishing ‘cause’ from ‘effect’ was generally absent across the industry. This makes the KXI concept superior because it enables firms to understand the relationship between their own actions and clients behaviour.

Why we conducted this project

In November 2019, the members of the Asset Management CX Forum agreed the CX Maturity Benchmark data highlighted the industry’s biggest CX-related issue as firms’ abilities to measure CX.