Resources and playbooks

Seize a competitive edge with asset management client engagement research, made possible by the Client Behavior Benchmark.

In a changing landscape in which only the most adaptable should expect to survive, Distribution Leadership Teams can use this blueprint to manage the contribution of their pre- and post-sales CX to their quarterly financial results.

What is the behavioral science behind a 5-level client retention strategy? In the ‘survival of the fittest’ market, if you underperform at engaging clients, they will give their time to your competitors … and then their money. To give firms a new competitive edge, this playbook shows asset managers HOW they can lengthen their client tenure and deepen their product-per-client ratio.

What digital experiences are asset managers giving to institutional clients today through portals, and what are they planning for the future? Which services are the same through a portal, which can you improve, and which ones enable you to generate entirely new value? And how are firms tracking clients’ online behaviors to ensure the ongoing relevance of their digital experiences?

Accomplish’s research into ESG-related client behaviors shed light on the nature of clients’ demand for ESG investment services and raised the potential for this to shift. Asset management firms will need skills and budget to serve the needs of greater volumes of experienced clients and their product strategies may also need to evolve. This will present strategic opportunities and threats.

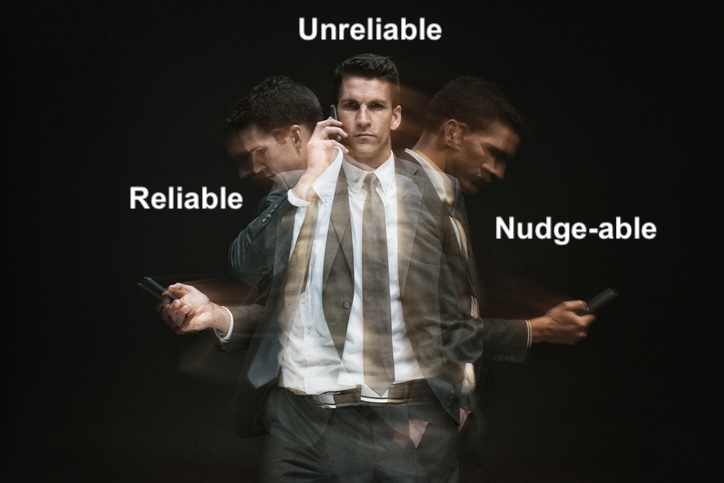

Actions speak louder than words, so asset managers should measure client behavior to focus their organization on what matters most (which is whether or not clients buy, stay, or buy more), and what you can do to stimulate client behavior. In contrast, humans are tricky creatures, so you cannot rely on what they say. This makes actions, not words, the reliable indicator of demand and, therefore, it makes client behavior the perfect business target: meaningful, commercial, and professional.