The Asset Management

Client Behavior Benchmark

If you underperform at engaging clients, they will give their time to your competitors … and then their money

Welcome to a new era in which asset managers can discover, in time and money, where they out and underperform at engaging clients. At Accomplish, we are behavioral scientists who run the global asset management Client Behavior Benchmark.

The problem – to win the battle for engaging clients, you need to find out how you compare against other asset managers.

The solution – the Client Behavior Benchmark is a unique set of institutional engagement data that lets you see ‘snapshots in time’ and multi-year trend analytics. At Accomplish, we believe will help create winners and losers.

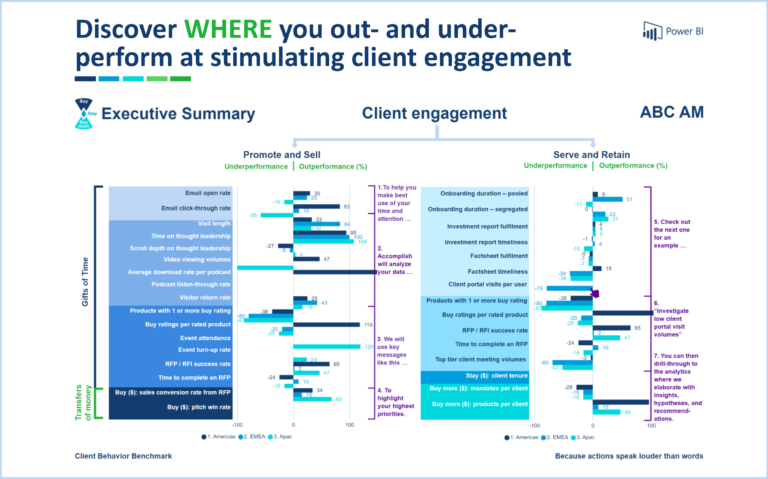

- See, in time and money, WHERE you out- and under-perform at stimulating client engagement.

- Manage your institutional sales funnel and end-to-end client journey holistically – marketing, sales, and service.

- Widen your sales funnel for as long as possible.

The solution (part 2) – check out Accomplish’s behavioral playbooks to discover HOW to outperform at engaging clients while, at the same time, giving them a better experience.

“By codifying and quantifying the behavioral sales funnel, you have created extreme value.”

An Institutional Relationship Director.

Adam Grainger explains how to use the asset management Client Behavior Benchmark to keep your sales funnels as wide as possible for as long as possible.

The strong are getting stronger … discovering where they underperform and fixing it

The asset management Client Behavior Benchmark – business intelligence that pays for itself

Typical buyers

- All metrics – Distribution COOs, heads of client engagement, client insights, business intelligence.

- Promote and Sell – heads of marketing and sales enablement.

- Serve and Retain – heads of post-sale service and client experience.

Choose the package you need

Coherent, purposeful, and practical packages give you control over the metrics you participate in. Promote and Sell is for marketing and sales teams, and Serve and Retain is for relationship and service teams. Both include measures of the relevant gifts of time and transfers of money for these areas.

Ways you can access the dataset

Join the new wave of asset managers participating in the Benchmark, through our current free one-quarter no-obligation trial. This will help you evaluate your business case now in preparation for 2025. Or pay to gain immediate access to either 1 or 2 year’s worth of trend analytics. Contact us if you would like to discuss your options.

What if you do not join the Benchmark?

You do not have to join the Benchmark – the choice is yours – but the alternatives risk disabling disadvantages.

Data integrity

At Accomplish, nothing is more important to us than the confidentiality, integrity, and availability of our data. Learn more about how our quality checks protect data integrity and ensure comparability.

Position on artificial intelligence

Lastly, the most common question people asked Accomplish in 2023 was whether we use artificial intelligence (AI) to analyse client data from the Client Behavior Benchmark and create recommendations. The answer is no. Click-through to discover why.

“We used to think we ‘did’ insights well, but it turns out we were just paddling in the shallow end.”

A Head of Business Intelligence.