In brief

There are two types of indicators of client behavior – leading and lagging ones – and this article focuses on the 3 lagging indicators. For the investment industry, they are ‘buying’ (sales conversion), ‘staying’ (client retention), and ‘buying more’ (products-per-client). These behaviors involve transfers of money, which gives them the rare feature of being dollarizable because they – and only they – pay the bills. If they point the wrong way for too long, the situation could become life-threatening for the organization, which makes them a vital component of your institutional asset management business intelligence.

The dollarizable client behaviors and how to measure them

“What is more important than whether or not clients buy, stay, and buy more?”

A Distribution COO.

Most client behaviors are not dollarizable. For example, time spent on your thought leadership web pages, podcast downloads, event attendance, meeting volumes, or RFP successes. They are important metrics to monitor because they are leading indicators that you can stimulate directly.

But no money changes hands during these activities, so you cannot assign a monetary value to them. Instead, they involve ‘Gifts of Time’ so we measure them via the seconds, minutes, and hours that clients give to engaging with your firm at different points along your client journey.

In contrast, 3 lagging behavioral indicators will tell you whether your clients have bought, have stayed, and have bought more. Because they involve transfers of money, they are dollarizable, so they – and only they – will pay the bills.

Let’s make sure we’re aligned on the definitions in the context of institutional asset management:

- Buying (sales conversion) – you can measure your effect on client buying behaviors through two sales conversion metrics: the percentage, first, of all the pitches that you won and, second, of RFP successes that you converted into wins. The first will tell you the strength of your sales capability and let you evaluate the performance of different salespeople. The second minus the first will show the value of your RFP process, which should be positive and exceed its own costs.

- Staying (client tenure) – we measure client tenure through the average length in months of all your client relationships. It will show you how effectively your firm retains its largest source of revenue – existing clients.

- Buying more (product-per-client) – the best way to retain a client is to deepen your relationship with them, and study after study has found that it will cost you materially less to sell to your existing clients than to win new ones. So, we measure relationship depth as being the average number of products per client.

Extract valuable insights and make informed decisions

Now let’s explore what you can do with your lagging behavioral indicators. At Accomplish, we see firms exploit them in three main ways:

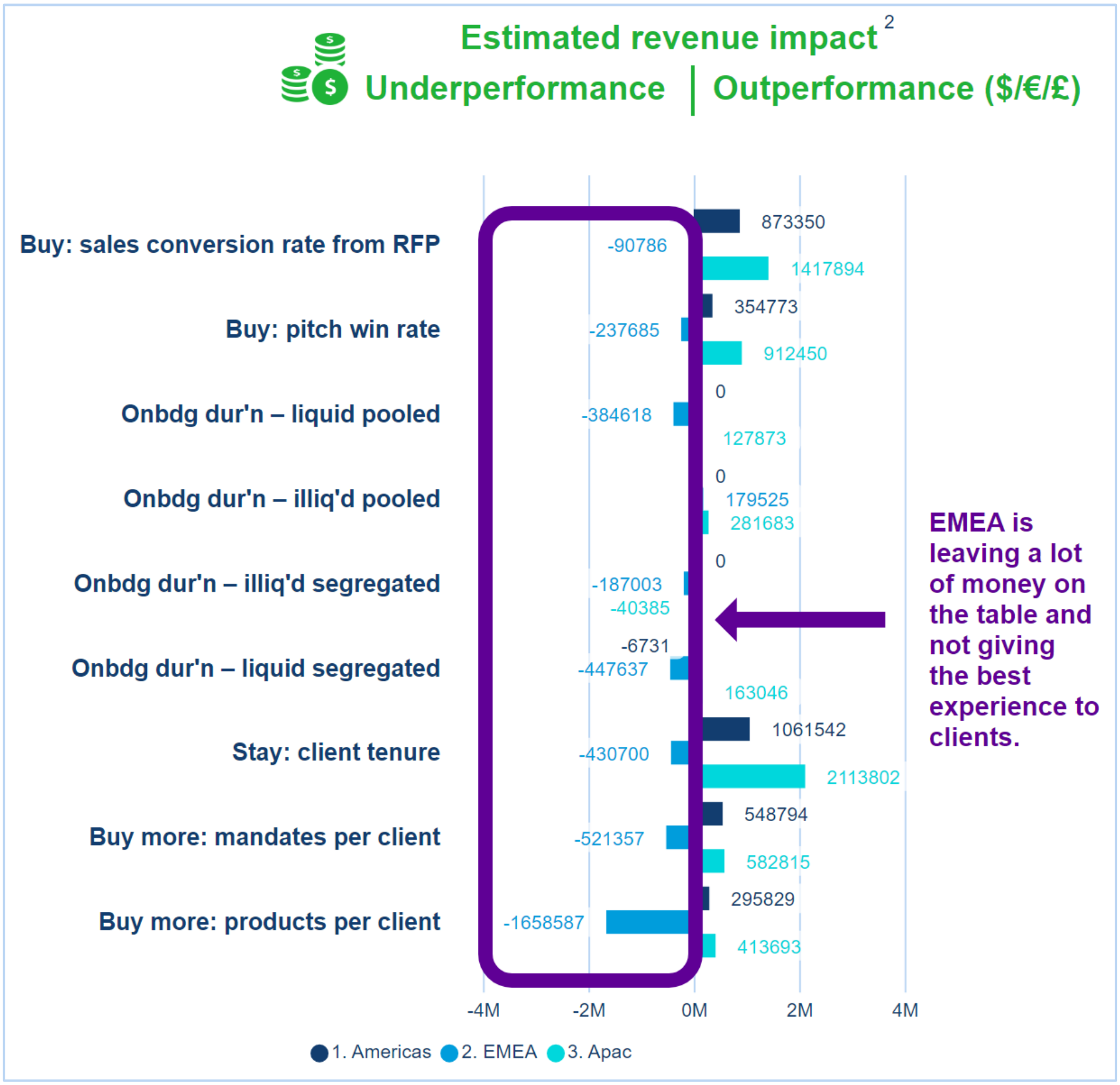

Quantify the revenue impact of your effect on client behavior – once you know your effect on a particular behavior, you can combine it with management information to quantify the impact on revenue. This is why we refer to ‘dollarizable’ asset management business intelligence.

For example, if your pitch win rate was 50% and the average of other asset managers was 40%, you can combine this with your weighted average fee rate and total pipeline size to quantify the impact on revenue of your outperformance at creating this buying behavior. You can perform similar calculations for client tenure and products-per-client. This enables you to make informed decisions like these:

- Sales conversion – which salespeople are best at stimulating ‘yes’ decisions in clients? And can you assign them to the accounts you want to grow?

- Client tenure – what skews exist in your data that could indicate any key client dependencies? And what age of client relationships are most at risk and how can you factor this into your client retention plans?

- Product-per-client – are there any combinations of products that sell well together? And could this create new opportunities for you?

Set balanced targets and track progress frequently – remembering that your firm will be on a journey and will have ambitions, you can set targets for each indicator and integrate them into your sales and retention plans. Some firms do not yet have targets for client tenure and products-per-client, but adding them will create a balanced set of incentives. This is because it reduces your overall cost of sale by alleviating any reliance on the most expensive source of revenue – new clients. As one of Accomplish’s benchmarking clients said on stage in 2023, “what is more important than whether or not clients buy, stay, and buy more?”

Respond quickly to changes in client behavior – lastly, behaviors change, and market norms evolve. In the two years we have been running data through the benchmark, we have seen tactical changes in things like RFP success rates, as well as strategic alerts like quarterly client tenure flashing red because an asset manager was losing younger client relationships. Finding out early and in an evidence-based way will help you respond fast and keep out of trouble.

Dollarizable asset management business intelligence

The Client Behavior Benchmark is a great tool that lets you achieve all of this:

At the executive level, you can see ‘at-a-glance’ your out- and under-performance in currency terms across all lagging behavioral indicators – sales conversion, client retention, and products per client.

At the business management level, you identify your priorities by filtering and sorting your data and selecting different tolerance levels for your dollarizable variances from the benchmark.

At the subject-matter expert level, you can calculate in currency terms the value of your out- or underperformance compared to other asset managers.

To conclude, not all asset management business intelligence is equal, so we hope you enjoyed this article and that it got you thinking about the importance of lagging behavioral indicators and how you can use them to manage your effect on whether clients buy, stay, and buy more.

If you would like to discover more, head to the Client Behavior Benchmark page where you can watch a video of the benchmark and the dollarizable client behaviors in action, discover more about what you can do with the client behavior data that’s in your systems and, if you’d like, book a demo with us.