ESG-related client behaviors

Actions speak louder than words

Accomplish’s Client Behavior Benchmark enables asset managers to measure, compare, and predict client behavior. Why? Because what humans do is a much more reliable indicator of demand than what they say.

Our research into ESG-related client behaviors was different. Whereas the benchmark measures known behaviors on an ongoing basis – like buying, staying, and buying more – the ESG research identified previously undocumented behaviors as a one-off piece of primary research.

The findings are important because they shed light on the nature of clients’ demand for ESG investment products and services and raise the potential for this to change.

Research methodology

In Q2 2022, we gathered objective observations from 41 asset management firms about the behaviors their institutional and intermediary prospects and clients from around the world displayed in relation to ESG.

To ensure we interpreted the data correctly, we collaborated with Harald Walkate who is a Senior Fellow at the University of Zurich’s Center for Sustainable Finance.

To explore the data further, we ran it through Walkate’s Today / Tomorrow Framework, which maps an organization’s focus on the topic of ESG.

Key findings: ESG -related client behaviors

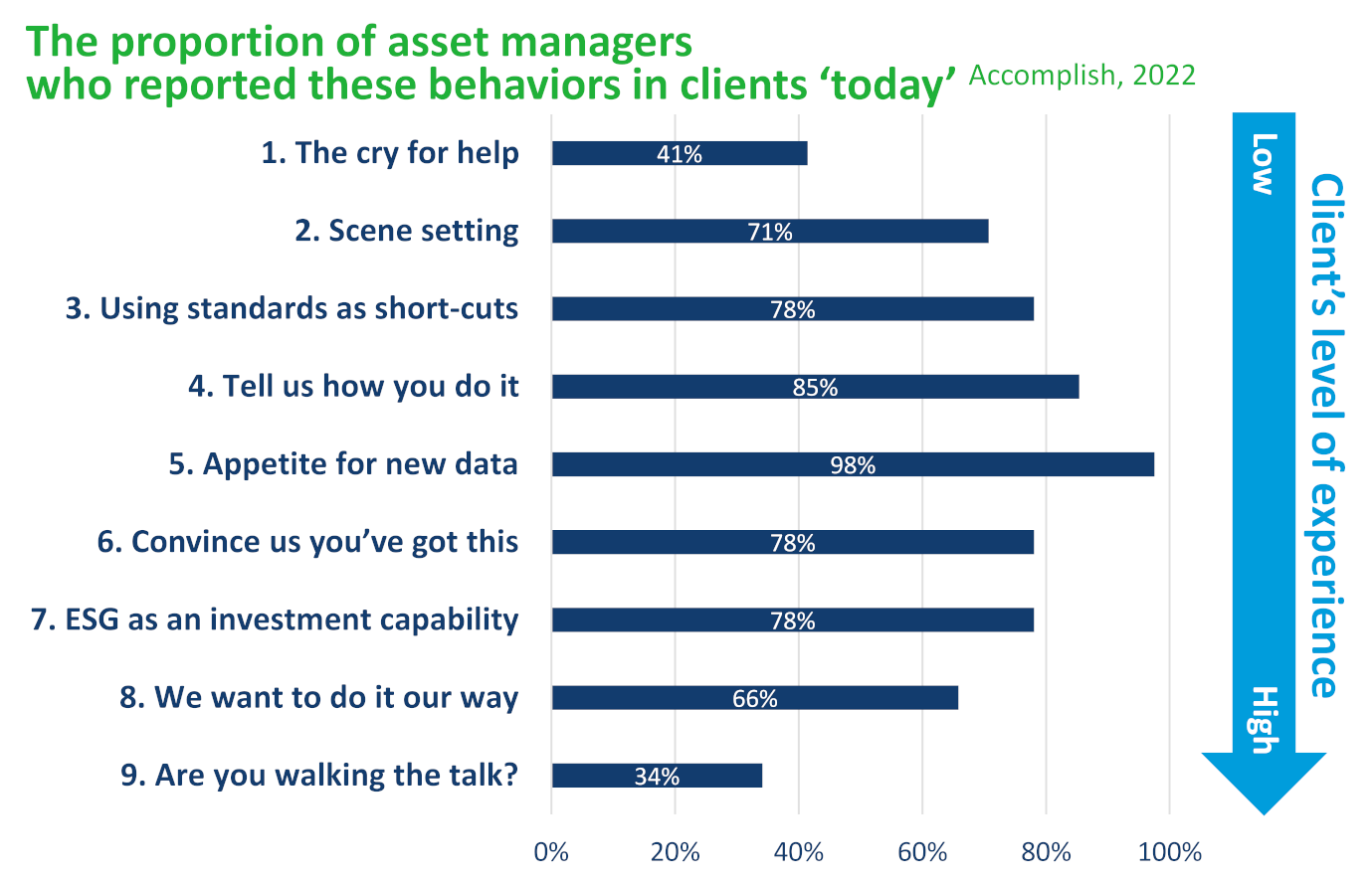

We found 42 distinct ESG-related client behaviors across 9 categories, with clients displaying behaviors from multiple categories. As you can see below, asset managers reported some categories of behavior more often than others. Crucially, they reported that a client’s behavior differed depending on whether, in their opinion, the client had more or less experience of the discipline of ESG.

The 9 categories of ESG-related client behavior

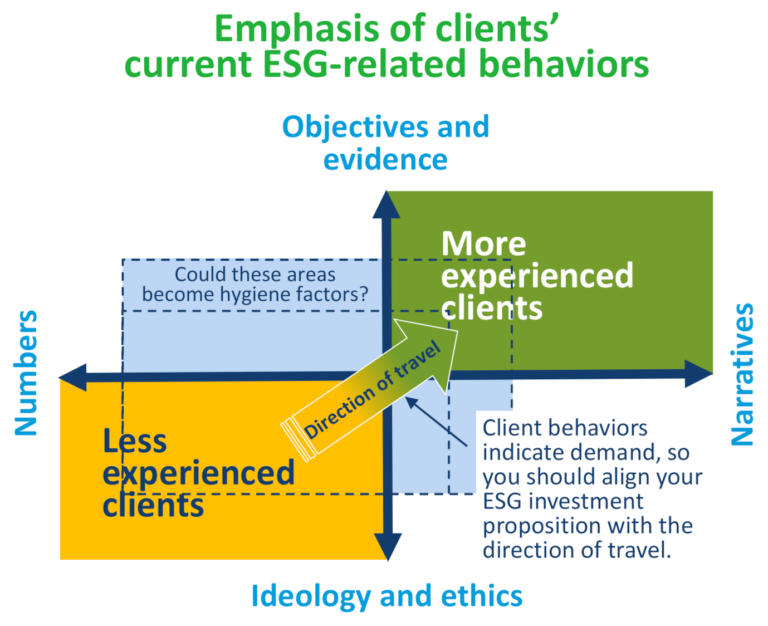

When we examined the behaviors through the lens of Walkate’s Today / Tomorrow Framework, we found a contrast between those displayed by clients with less experience and those with more.

In general, ‘less experienced’ clients focused more on quantitative factors, with a bias towards closed questions and without an apparent direct link to a real-world objective. On Walkate’s model, they aligned with numbers, ideology, and ethics. In contrast, ‘more experienced’ clients appeared to adopt a more balanced position of also demonstrating demand for understanding through open questions and qualitative explanations of investment relevance. On the model, they also operated in areas associated with narratives, objectives, and evidence.

For example, a less experienced client might ask for engagement and voting volumes and statistics (behavior #5.6), whereas a more experienced one might also ask how you engaged a company, what you aimed to achieve and why, progress made, successes, failures, divestment assessments, and implications (#6.3).

Strategic implications for asset managers

If clients occupy different positions on Walkate’s model depending on the extent of their experience of ESG, then ESG-related client behaviors do not have to be static, but can and do evolve as they gain experience. This raises potential for a change in demand for ESG-related propositions.

We hypothesize that the general direction of travel will be diagonal. We do not expect clients to depart the bottom-left quadrant as they gain experience. We consider it more likely, instead, that the size of their ‘footprints’ will grow as they extend up the diagonal to adopt a more balanced position.

This implies that firms will need skills and budget to serve the demand of greater volumes of experienced clients and the behaviors they display. Returning to the example of engagement and voting, providing standardized data (behavior #5.6) costs much less than the rich level of transparency that #6.3 calls for. Clients may want both.

Referring to Walkate’s use of his own model (above) to map different ESG disciplines, a change in demand up the diagonal also implies that firms’ product strategies may need to evolve as clients, in general, adopt a more balanced position.

What asset managers should do

We believe the findings of this research present strategic opportunities and threats for asset management firms, and we encourage them to perform a SWOT analysis against page 10 of the report.

Specifically, we recommend you analyze the behaviors of more experienced clients and the potential impact on your ESG products and services of a market in which they become more prevalent. For example:

- Where are your firm’s strengths and weaknesses, and how significant are they?

- Where are your gaps, and which ones are important to you?

- Where will the capability come from to rectify any weaknesses and gaps – will you develop skills in-house, secure them through hiring or acquisition, or a mix of different approaches?

- Where will the budget come from – will clients pay more, or will this erode your profits?

Why should you act? Because actions speak louder than words: client behaviors indicate demand, so you should align your ESG investment proposition with the direction of travel.