Impact of COVID-19 on asset management CX

COVID 19 through the lens of CX

In this client-led impact assessment, we explore the asset management response to COVID-19 through the lens of client experience, or CX.

We gathered data and perspectives from heads of distribution, strategy, client services, and CX by asking them open questions about what had happened. We are proud of the asset management CX community for providing an 84% response rate across individual members of the Asset Management CX Forum that is collectively responsible for €2.6tn of institutional AUM.

We timed the project to capture not just the immediate response, but also the end of the first quarter, the stabilisation activities once firms had ‘taken stock’ of the situation, and an early view of the longer-term direction of travel.

Asset management response to COVID-19

Emergency response and triage

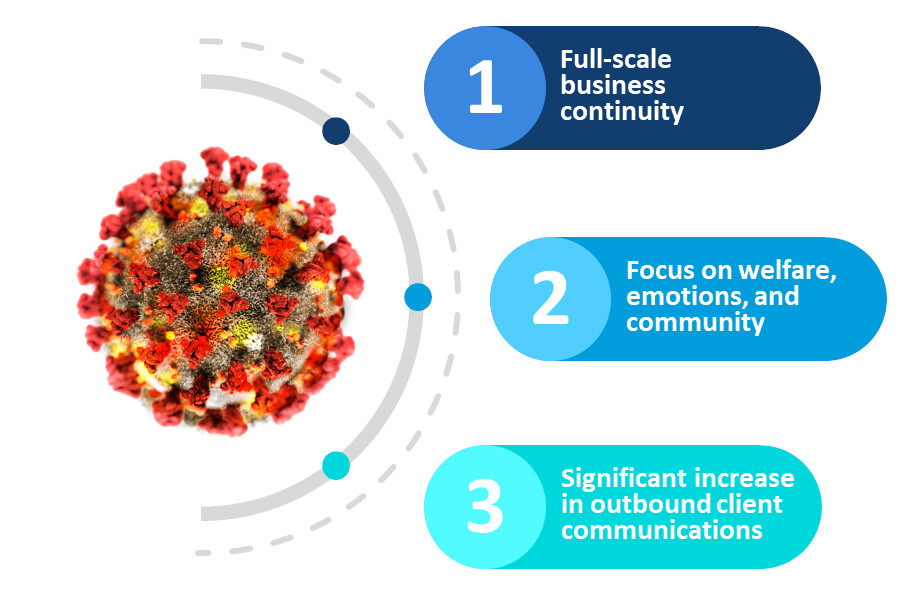

For most asset managers, the initial hours and days of the crisis were similar.

This period involved full-scale activation of business continuity plans more broadly than few had anticipated – this wasn’t just the loss of an office building in place of a disaster recovery site, this was the loss of everyone’s offices.

The next pattern in the data is something the investment industry should take pride in: it focused on welfare, emotions, and community. Firms implemented flexible working arrangements, staff formed support networks for each other, and managers invested much of their time to staff wellbeing. It is now very much OK to talk about emotions.

Thirdly, the move to check-in on clients was fast and took place across every available channel of communication. Were they OK, did they have everything they needed, and how were they feeling about markets?

That completed the ‘triage’ phase of the asset management response to COVID-19. How they responded to what happened next was what separated firms.

New client needs emerged

Once clients had adjusted, new needs emerged that we analysed using Accomplish’s Model of B2B CX which distinguishes rational and emotional needs at both the individual and corporate level.

Regardless of any past reluctance to adopt digital self-service, the survey data indicates that investment clients underwent a rapid conversion because, quite simply, they had to.

Time was in short supply for everyone: clients guarded it carefully, and, under their own pressures, they expected faster query responses and more frequent updates. Their home lives featured in meetings too and empathy and emotions entered B2B relationships like never before.

At the corporate level, clients wanted comfort that their precious treasure was safe, they wanted honest dialogue that involved acknowledgement of what wasn’t known, and firms reported clients appreciating flexibility around in-flight projects impacted by the changing situation.

Assessing firms’ responses through the lens of CX

We compared firms’ responses with the strength of their internal CX capability, as measured by the Accomplish CX Maturity Benchmark (March 2020).

The key finding was that asset managers that entered lockdown with stronger CX capabilities were better able to meet clients’ new needs and seized the opportunity to extend their lead.

In general, these firms, coordinated their efforts with dashboards of live data, mitigated the highest volumes of queries with automation and broader relationships with clients.

Their client journeys were already digital, so they accelerated the roll-out of planned improvements and sought opportunities to be memorable by going ‘above and beyond’.

They also used the power of consolidated data pools and agile marketing to go on the offensive in a sustained pursuit of their growth targets.

Conversely, firms with weaker CX capabilities sprinted to stand still because they needed to prioritise things differently.

They built ad hoc trackers through which they managed a “tsunami” of client queries and narrower client relationships risked both client satisfaction and staff welfare, so they re-allocated resources from other activities to help out.

The rapidity of the move to ‘remote everything’ exposed a few operational processes that wouldn’t work in this environment, which meant these firms had to automate processes quickly and concurrently.

These firms tended also to have fragmented pockets of data, which makes aggregation and analysis slow and difficult. Commercially, this group of firms adopted a defensive stance.

Two-thirds expect CX to become more important

Looking at the asset management response to COVID-19 more broadly than CX, 100% of firms are revising their strategies in response to the macro shock and the new normal. Two-thirds (68%) of respondents expected CX to play a more important role in these new strategies. Their logic followed three paths:

- “Revenue retention rules”

- “Being digital is no longer a differentiator, so we’re doubling-down on CX”

- “We recognise we need to catch up on CX”

No firm expected CX to decrease in importance, so the remaining one-third expected it to maintain its current importance to them. Again, within this data, there were three patterns – the first two of which are actually also ‘votes’ in favour of CX:

- “We have already embedded CX into BAU”

- “Improving our CX was already a top priority and will remain so”

- “We would like to embed CX, but we just can’t prioritise it right now”

The direction of travel

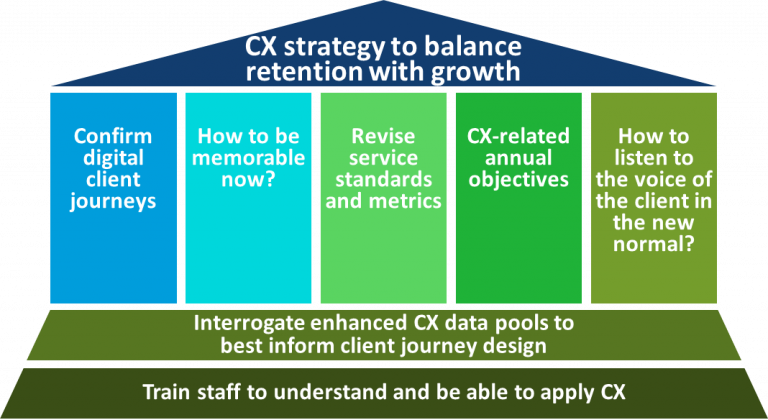

Lastly, the two-thirds of firms that are planning a bigger future role for CX are intending to take the following steps as a way of balancing retention with growth:

- Confirm their end-to-end client journeys are 100% digital.

- Identify how they will be memorable in the virtual environment.

- Revise service standards and metrics for the new environment.

- Ask all employees to develop CX-related annual objectives.

- Establish a mechanism for listening to the voice of the client in this new environment.

- Enhance their CX data pools from all the new online activity, analyse it to confirm what clients want, and identify different segments to best inform the design of their client journeys.

- Train staff to give them the knowledge and understanding of CX they will need, as well as the ability to apply it.