News

Voice of the client – an industry sample

Alignment is about remaining relevant

In Q2 2020, we ran a project for peer-group members of the CX Forum to discover how they listen and respond to their ‘voice of the client’ (VOC).

We did this to understand how firms perform this vital function, that is, what is working well and less well, and whether anything may be missing from common practices.

At Accomplish, we see VOC as being vital because, even though clients’ needs evolve, your continued alignment with what they want will drive their ongoing impression of your value. So firms need to detect changes and flex accordingly.

In a survival-of-the-fittest market, this is about remaining relevant.

Leading-edge voice of the client practices

At a high level, we found a patchwork of strengths and weaknesses, as well as surprising indications of waste from under-utilization of client feedback data. To help firms address the issues, we have proposed firm- and industry-level solutions for the gaps we found.

We reserve the detailed findings for our member firms, but there were some key patterns in the data that we are pleased to share with everyone here.

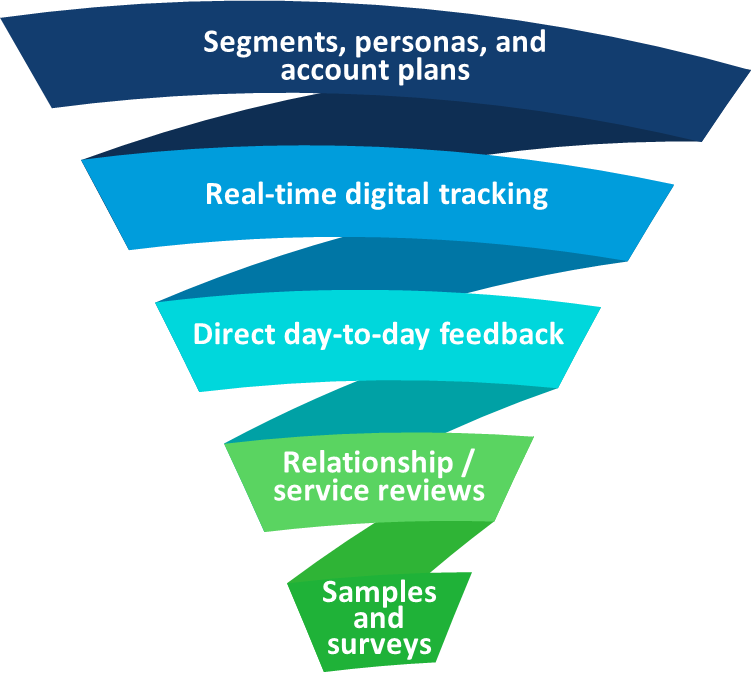

In particular, across five key aspects here are some of the best examples we encountered of asset managers listening to their ‘voice of the client’:

- Segments, personas, and account plans – it appears to be the exception rather than the norm for firms to have developed and implemented personas, as well as to maintain them on an ongoing basis as up-to-date assumptions about what their clients want.

- Real-time digital tracking – at the leading edge of CX, we found firms using clients’ ‘revealed online preferences’ to maintain and refine their personas, to estimate interest in marketing campaigns, as well as to compare the effect they have on their clients against their internal production metrics.

- Direct day-to-day feedback – some firms have standardised meeting and call reports, that they digitise at source, upload into CRM, and compare against clients’ digital footprints. This enables them to identify differences between ‘what clients have said vs. what they have done online’. This is not about checking up on clients, this is about completing your picture of their interests.

- Relationship / service reviews – in these less frequent meetings, the firms that have already been tracking and reacting to real-time and day-to-day information, are shifting the agenda to strategic questions like ‘what more could we do’. At Accomplish, we believe this is the right approach. In the experience economy, you cannot afford to wait a year or even a quarter to ask how it has been going: you should know already and have responded.

- Samples and surveys – developing the last point, we found a small vanguard of firms that are increasingly favouring client sampling, instead of surveys. At Accomplish, we support this too: CX operates on the emotional level where a good experience is forgettable and only the extraordinary gets remembered, shared, and discussed. These emotions are best captured ‘in the moment’.

It was a privilege for Accomplish to facilitate the structured, balanced, and protected environment that enabled these key industry players to describe their voice of the client activities in the overall interests of improving the experience clients receive from asset managers.

We are pleased with the unanimously positive feedback from participants, and we are looking forward to the next peer-group project that is already under development.