News

Applying segmentation and tiering for asset managers

Developing an effective tiered client segment is challenging and requires a balance of capabilities and trade-offs between revenue and expenses.

Our research indicates that it is worth it though, and the prize is a business model that secures strategic value by maximising top-line sales and optimising bottom-line profitability.

In this second blog in our three-part series, we demonstrate through the lens of CX Accomplish’s preferred approach to applying segmentation and tiering. For a refresh on the difference between these two practices , check out our first blog

Firstly, how have we defined ‘strategic value’?

To us, strategic value occurs when a business practice creates a trend that improves multi-year profitability. Example trends include greater organic growth, efficient prospecting, minimised complexity, lower operational risk, and optimised operational costs.

Conversely, we see tactical value as affecting only current-year profitability. Its drivers include material but less repeatable sources of value, such as exceeding the expectations of individual clients and consultants.

Accomplish’s approach to applying segmentation and tiering

We know from our research that there is more than one way to secure strategic value from segmentation and tiering.

Here’s our approach that combines the ‘best-of-the-best’ in terms of the number of ways it positively impacts multiyear profitability.

Let’s explore it in detail, so you can re-configure it to suit your needs. And please get in touch if it raises any questions for you.

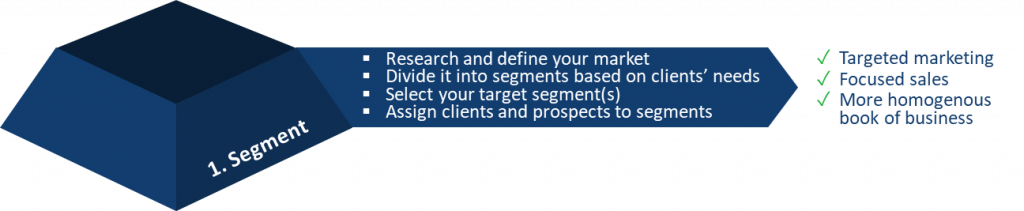

Step 1. Segmentation

Your first task should be to clarify where you plan to operate, and where not. Most of Accomplish’s clients operate in (at least) the global institutional investment market. They have used market research to choose this market and this choice represents the earliest moment we encourage asset managers to begin considering CX.

Use that research to divide your market into segments based on clients’ needs. Common segments include pension funds, insurance companies, corporates, endowments and foundations, and governmental bodies. At this stage, focus just on differences in clients’ needs, e.g. what type of organisations need Solvency 2 reporting? Insurers = yes; other types of clients = no. Don’t feel constrained by these common segments: it may also make sense in your situation to identify a particular jurisdiction as a segment, or all clients in a specific product.

Next, select your target segment(s). These should be the ones that are most attractive to your business, with firms commonly seeking the largest and most profitable segments, as well as considering whether they have sustainable access to the segment and whether its needs are aligned with their capabilities.

Your segmentation finishes when you assign clients and prospects to your target segments. This should be a relatively uncontroversial process: an endowment is hard to confuse. But be ready for the occasional internal turf war, e.g. in your model, will a government-sponsored pension fund be a pension fund or a governmental body?

Linking Step 1 to strategic value, it will enable efficient prospecting by allowing your company to target defined segments through its marketing. A focused sales effort follows naturally and yields client relationships that are similar to each other, which makes servicing them year-on-year easier and more efficient. These are big wins and are some of the key reasons for keeping segmentation distinct from tiering.

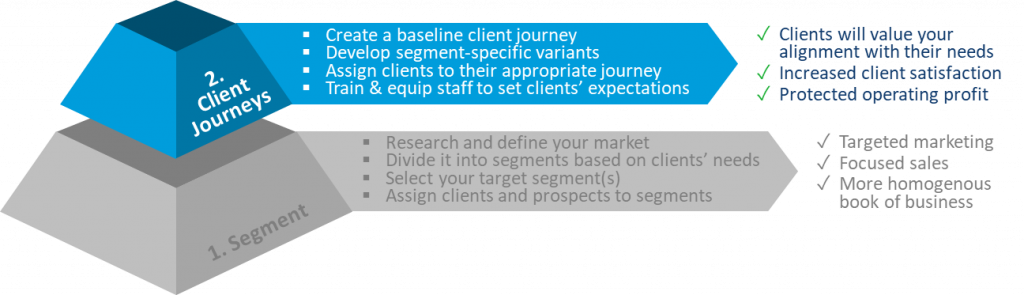

Step 2. Client journeys

Now that you have defined your target segments, Step 2 is about aligning your business with their needs and serving them as effectively and efficiently as possible. There are four main tasks.

Firstly, create a baseline client journey. It should include the end-to-end stages you will use from how a prospect becomes aware of you, researches, evaluates, and selects you, through onboarding and all the aspects of service consumption to termination and exit.

Visualise the ‘moments of truth’ alongside the remaining touchpoints and sequence them into a coherent and explainable experience. Identify the touchpoints that you will and will not differentiate for different tiers. You will need this in Step 3. And, if there are ‘pain points’, inefficiencies, or UX issues today that affect multiple segments, analyse them, and develop solutions.

You can now derive segment-specific variants of your baseline client journey consistently and efficiently. This consistency will protect your operating costs. Develop personas to convey to colleagues the needs, behaviours, and goals of different segments, and find out what your competitors are doing, and how your CX is performing relative to them.

Use this information to determine what you need to do more of, less of, or differently for them compared to your baseline. At Accomplish, we like a client journey to meet the needs of at least ~80% of clients and to have a set of pre-approved customisations for the remainder – should they ask.

Next, train your client-facing staff to present the client journeys to their prospects. Equip them with collateral that presents in an intuitive, coherent, and engaging way what life will be like as a client. And make sure they know their scripts and the controls around responding to any bespoke requests.

Lastly, assign clients to their appropriate journey. Because you have already assigned them to segments and designed the client journeys to align with each segment’s needs, you should have reduced the scope for controversy. You will, however, need to decide your appetite for handling clients who may still lose part of their existing service – will you migrate them to the new client journey, bypass them for now and ‘grandfather’ them across later, let them run-off, or a combination of all these options?

How does Step 2 drive strategic value? Client journeys designed for each segment will create the correct impression that you understand and are aligned with their needs. Clients will value this. This approach of a baseline, with segment-specific variants and a set of pre-approved customisations, will achieve this while minimising the operational costs and risks of servicing. And, by aligning clients’ expectations with your planned delivery you will increase the chance of meeting your promises and keeping them satisfied.

Step 3. Tiering

Now that you have placed your clients into journeys that are designed to meet their needs, it is time to prioritise them relative to each other. The aim here is to ensure sales and servicing teams neither over- nor under-invest in relationships as they pursue opportunities and defend against risks.

Your first task is to define your objectives in your various markets, for example, you may be in growth mode in Territory A while being in revenue defence mode in Territory B.

The team in Territory A may identify asset growth as the most useful measure of its success, while revenue retention may be the more suitable in Territory B. A key advantage of our 3-step process of applying segmentation and tiering is that you can devolve the selection of tiering criteria to the teams that know their markets best. Also, because all clients are already receiving an experience designed for their needs, you can re-tier them in the future without causing significant disruption.

Next, decide how many tiers you will have across all markets. Our preference is for the fewest possible tiers and, increasingly, we are seeing firms with just two: ‘strategic’ and ‘core’ or, in other words, those we will customise for, and everyone else. Relationship owners assign clients and prospects to tiers and justify assignments to the ‘expensive’ tier. At this point, you should also consider key account plans for top tier clients, and an objective review and annual re-tiering process to ensure clients remain in their natural tiers unless a live opportunity or risk is being managed.

Lastly, differentiate time and resource allocations per tier for the touchpoints you identified in Step 2 when you designed your baseline client journey. For example, a client service team may manage the relationships with hundreds of core clients, while a dedicated relationship manager may look after only 10-15 strategic accounts.

Linking back to strategic value, tiering will inform everyone of the relationship owner’s assessment of the level of growth opportunity or departure risk. This will allow teams across the firm to prioritise their time and resources accordingly. In terms of multi-year profitability, this approach to tiering impacts both your level of organic growth and your ability to control costs through efficient resource allocation.

We believe this approach of applying segmentation and tiering is a superior one because it ensures every client receives an experience that is aligned with their needs while retaining your freedom to dial-up and dial-up tiering without significantly disrupting clients.

Follow Accomplish on LinkedIn

We hope you enjoyed this blog on applying segmentation and tiering. In the last article in this series, we will summarise our latest research, which was into how asset managers are managing the different needs of different clients today.

Follow us on LinkedIn to stay up-to-speed on all our other publications and the remainder of this blog series:

- Is there any difference between segmentation and tiering?

- Applying segmentation and tiering for asset managers

- Latest research: current industry segmentation and tiering practices

As a discipline, CX is still in its infancy and this is particularly the case in the context of business-to-business (B2B) asset management.

Accomplish is an information services company that is changing this by establishing the case for CX and helping asset managers stand out from the crowd with new tools and standards.