In brief

The big news is that the Client Behavior Benchmark is now calculating the dollar impact of asset managers’ abilities to get institutional clients to buy, stay, and buy more. If, as the Financial Times has reported, “the golden decade is over” for asset managers, then you should exploit these strategic and dollarizable client behaviors to calculate the ROI of different distribution activities. This will keep you ahead of the competition and out of trouble.

Welcome back to our blog series on what you (the asset manager) can do with the Client Behavior Benchmark.

Across five articles, we explore how you can now dollarize asset management business intelligence, cater for regional differences in behavior, make science-based improvements to your client journeys, connect your distribution strategies, and alleviate clients’ survey fatigue.

Your effect on client behavior is now dollarizable

Most client behaviors are not dollarizable. For example, time spent on your thought leadership web pages, event attendance, or meeting volumes. We call them tactical behavioral indicators: they are important because you can stimulate them directly, even though you cannot assign a monetary value to them.

However, there are a small number of client behaviors that are dollarizable. They relate to buying, staying, and buying more: they are strategic, they occur constantly, and they drive your profitability.

The big news is that the Client Behavior Benchmark is now calculating the dollar impact of asset managers’ abilities to stimulate these behaviors in institutional clients.

Firms are extracting value from data others are not even looking at

“We used to think we ‘did’ insights well, but it turns out we were just paddling in the shallow end.”

A Head of Business Intelligence

If, as the Financial Times has reported, “the golden decade is over” for asset managers, then you should stay laser-focused on these behaviors. For sure, investment performance is essential but, all other things being equal, if you do not get clients to buy, stay, and buy more, you are going out of business.

To keep ahead of the competition and stay out of trouble, firms are using the Client Behavior Benchmark to discover and target the competitive rates of sales conversion (buying), client tenure (staying), and product-per-client ratios (buying more). With these insights, they are then able to calculate the ROI of different distribution activities that stimulate these most important of client behaviors, for example, web engagement, event attendance, meeting volumes. Because of this, at Accomplish, we believe that focusing on these client behaviors will separate the winners from the losers.

Without these insights to guide your efforts, you may be left doing things the old-fashioned way: either comparing yourself against your own sales from last year, or not measuring at all – neither of which will serve you well in the market the asset management CEOs predict in the Financial Times.

Vital asset management business intelligence

Once you start benchmarking client behavior, the first thing you can do is identify client ‘leakage’ between one behavior and the next across your client journey. You can then use the dollar impacts to determine business cases for addressing any areas of relative underperformance. For example, you may be foregoing revenue unnecessarily by onboarding clients slower than the average, with every day of ‘excess onboarding’ compared to the benchmark equalling a day of foregone revenue.

Having identified strengths and weaknesses, you will be able to embed these insights into your annual targets. In another example, one firm saw how others were meeting with institutional clients more frequently than it was and noticed that they also had higher product-per-client ratios. This firm was able to set informed targets for achieving deeper client relationships as indicated by meeting frequency and measured by its product-per-client ratio.

Lastly, consistent and comparable quarterly data provides early warning of changes in client behavior. This will help you seize opportunities or discover vulnerabilities before it’s too late. A common example is how quarterly changes in average client tenure can alert you to the need to act: you may not be able to bring back the first few lost clients, but you can still respond quickly to avert further outflows.

Because of the nature of these use cases, the Client Behavior Benchmark tends to more than pay for itself. As a result, in Accomplish, we believe that client behavior has become vital asset management business intelligence for the digital era.

The industry’s benchmark of client behavior

In the words of Goldman Sachs in the Financial Times article: “asset managers need to work harder and be even more innovative.” Thankfully, the Client Behavior Benchmark is the result of an industry-wide innovation project so we have made this as easy as possible for new asset managers to join.

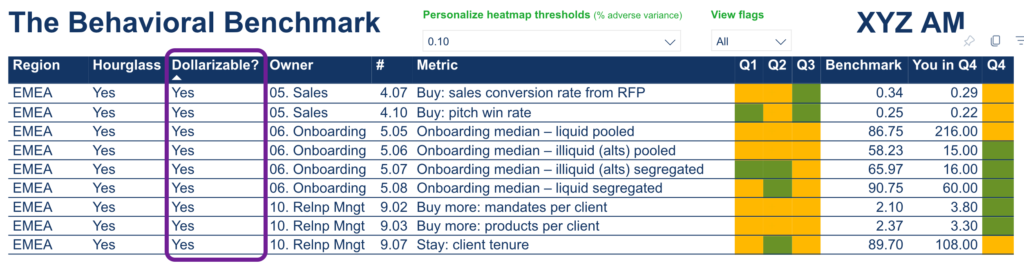

When you land on the benchmark, your dashboard will let you filter out the non-dollarizable client behaviors, so you can prioritise your analysis.

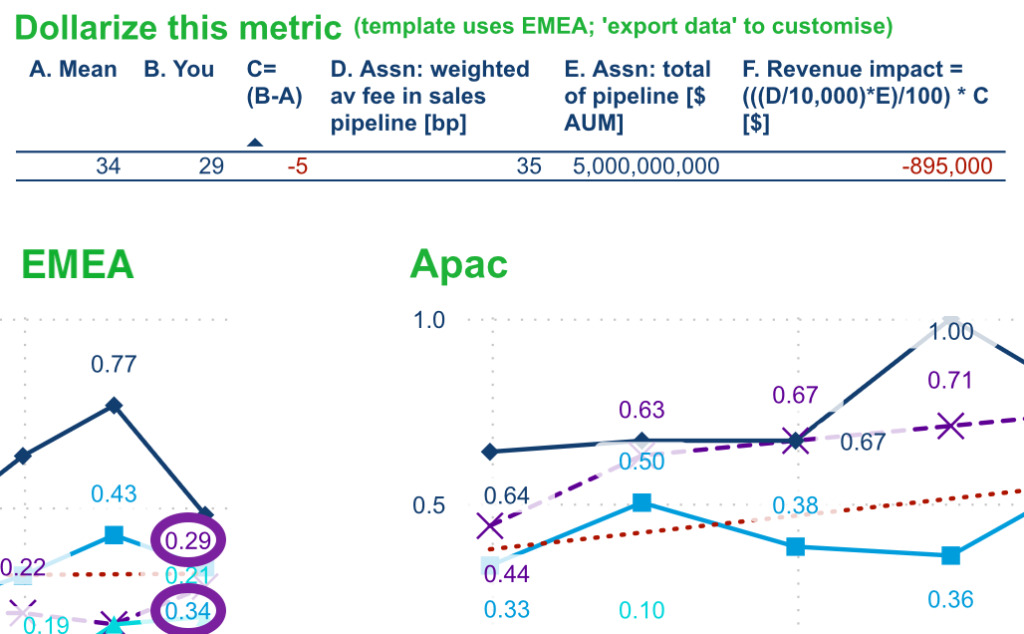

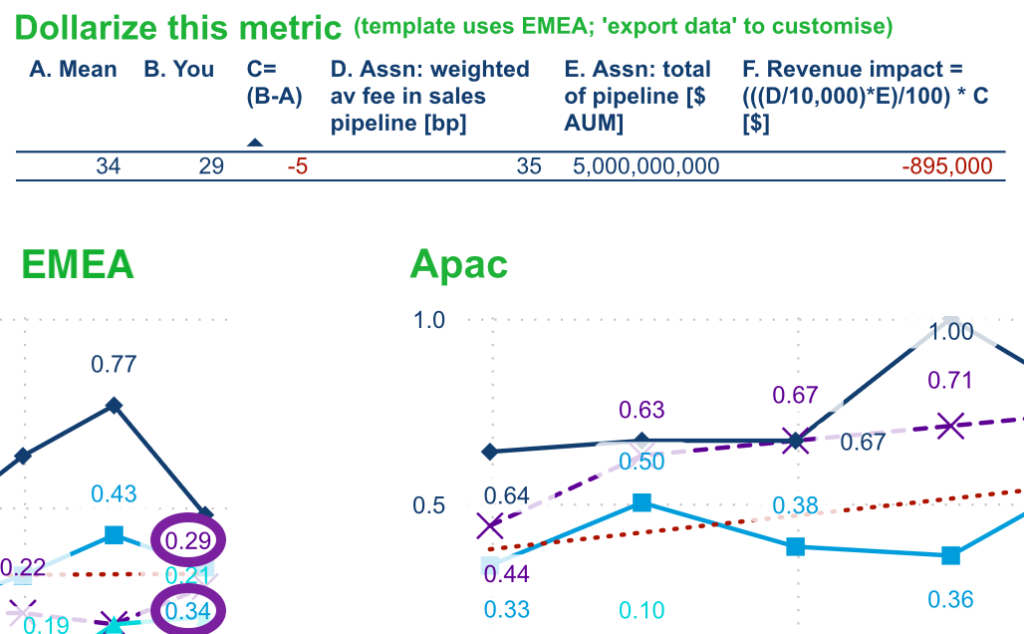

Let’s imagine you are interested in sales conversion rates: you will be able to drill through to the detail where there is now a dollarization table that will estimate the monetary value of your out- or underperformance.

In the above example, your EMEA sales conversion underperformed other firms by 5% (34%-29%), which the benchmark estimates cost you $895,000. In calculating this revenue impact, the benchmark combines actual data (you vs other asset managers) with customizable assumptions like a sales pipeline of $5 billion and a weighted average fee rate of 35 basis points. All you need to do is export the calculation and customize the assumptions to match your situation.

Lastly, in an executive summary, you will be able to see your dollarization estimates altogether at-a-glance, in case their aggregate impact tells a different story than when they are broken down individually.

The full series of blogs

In our opinion, not all asset management business intelligence is equal, so we hope you enjoyed this article and that it got you thinking about the importance of dollarizing your effect on client behavior.

Here are the other blogs in the series:

- Your effect on client behavior is now dollarizable.

- Optimize for behavioral differences.

- Science-based decision-making.

- Connect your distribution strategy.

- Alleviate clients’ survey fatigue.

Book a demo with the founder of the Client Behavior Benchmark if you would like to see it in action.