In brief

The annual planning season will soon be upon us but as Mike Tyson put it, “everyone has a plan until they get punched in the mouth.” Will you set yourself up to respond to the punches more effectively than your competitors? A behavior-driven distribution strategy is a cost-effective way to achieve this in a volatile environment: target specific client behaviours, and exploit relationships between client behaviors across segments, markets, and competitors.

Everyone has a plan until they get punched in the mouth

The annual planning season will soon be upon us. It is a process that has the potential to help asset managers allocate resources to the activities that will yield the greatest return.

However, according to US President Dwight Eisenhower, while “planning is everything, plans [themselves] are worthless.” He is not alone in believing this: it is a widely accepted truism that, as a 19th-century German army officer put it, “no plan survives contact with the enemy”.

Why is this?

Here asset managers might listen to the boxer Mike Tyson who once said that “everyone has a plan until they get punched in the mouth.” By implication, it is how you respond to taking the hits that will separate you from the losers.

What should we take from this? While your financial objective may not change mid-year, you should be ready to change your plan for achieving it as new information comes available. As a result, the process you institute for monitoring how your plan is going may be at least as important as the plan itself. Without it, you may just end up with another shiny slide deck that gathers dust.

The winners will respond to changes as they happen

The reason plans are imperfect is because they include assumptions, estimates and predictions about how clients and prospects will respond. To cater for this, asset managers monitor the implementation of their strategies so they can, as Gartner put it in 2021, ‘respond to changes as they happen’ – something it believed was one of four practices needed to navigate volatility successfully.

The problem is in the practice, not the theory.

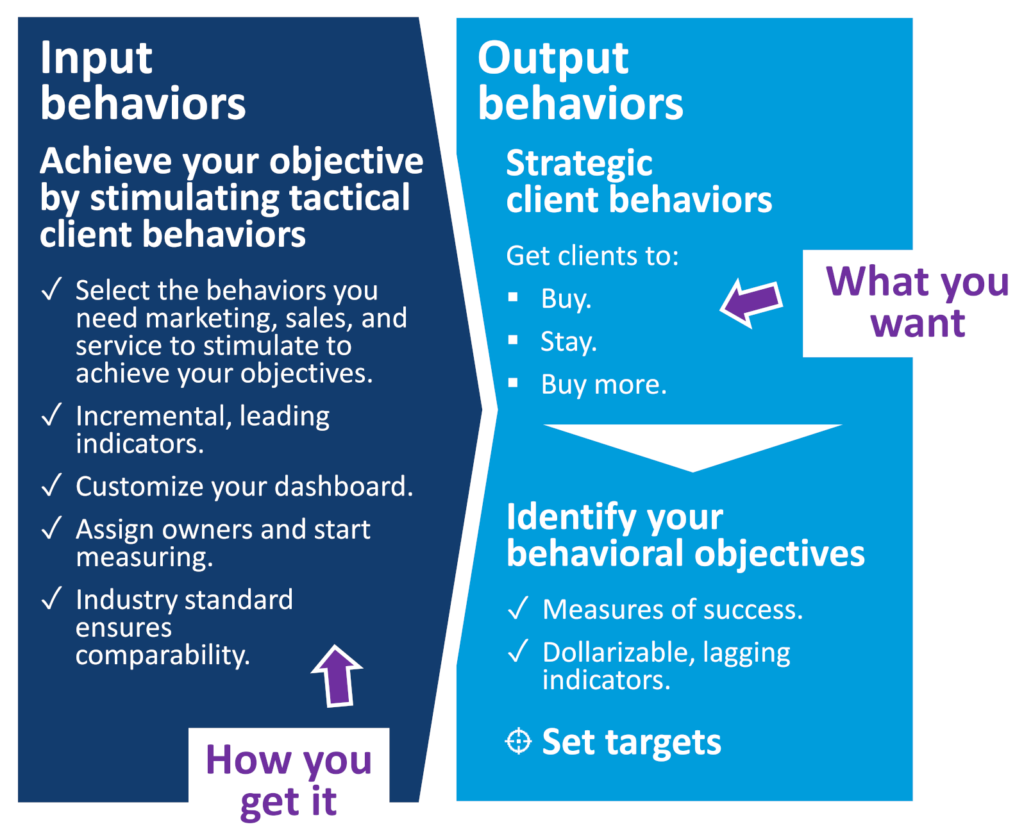

Typically, asset managers monitor client responses through the lenses of AUM, flows, and revenue. But these metrics do not yield return: they ARE the return. They are strategic ‘output’ client behaviors and, as such, they are lagging indicators. You can calculate their impact on your P&L, but you cannot influence them directly. Because of this, if they are all you measure, you may learn too late of a need to change your plan.

To respond to changes as they happen, you need to monitor the tactical ‘input’ behaviors that bring about the outputs you desire. For example, a client interested in buying a second product [output] may download product information, attend events, request meetings, etc. You will not be able to ‘dollarize’ these incremental inputs, but they are measurable leading indicators that you can stimulate via marketing, sales, and service strategies.

Because actions speak louder than words, the winners, therefore, will monitor both input and output client behaviors. In fact, they are already doing it through the Behavioral Benchmark.

Select the behavioral metrics you need

The benchmark is enabling asset managers to select the input and output behavioral metrics that will comprise their distribution strategy.

For example, to maintain a target level of client tenure [an output behavior that is a type of ‘repeat purchase’] one firm may aim to stimulate a combination of input behaviors – dwell times on thought leadership, event attendance, and meeting volumes.

To help them achieve this clarity, we take firms through a 3-step onboarding process:

- What are your strategic behavioral objectives?

- What client behaviors will you target to achieve them?

- And how will you measure success?

Strategic behavioral objectives

Another major advantage of embedding client behaviors into your targets and strategies is that you can align your underlying marketing, sales, and service strategies to stimulate the input behaviors you need for the outputs you seek.

For example, it is inconceivable that a client who is interested in buying another of your products will not want to meet with you. So if your strategic objective is deeper client relationships in terms of products, you should monitor meeting volumes in which you discuss complementary products your clients may wish to consider.

What we learn from this is that not only is a behavior-driven distribution strategy clear and easy to define, but it also gives you access to a whole new level of unique business intelligence.

As we approach the end of this blog, let’s recap:

- What data will you need, and what will you do with it?

- What processes will give you early warning that you should adjust your strategy?

- And, to use the words of Mike Tyson, how will you make sure your business is ready for getting punched in the mouth?

The behavior-driven distribution strategy

The reality of a behavior-driven distribution strategy has been made possible by the Behavioral Benchmark through which firms are not just measuring and comparing their effects on client behavior but also exploiting new behavioral analytics capabilities.

Designed for asset managers by asset managers, the benchmark has three unique features:

- Behavioral analytics because actions speak louder than words.

- Segment-specific client journeys – institutional and intermediary, across the Americas, EMEA and Apac.

- A self-governing user group through which the strong are getting stronger.

To learn more, check out the Behavioral Benchmark page where you can also book a demo and download a brochure.