In brief: 3 reasons to measure client behavior

Welcome to the final blog in a series on the advantages of benchmarking client behavior and how it is a welcome development for all.

In the first article, we examined how for most asset managers client experience (CX) has become THE reliable differentiator and why, to manage it, you need to measure it. In the second, we explained how CX is an ‘effect’ you ‘cause’ that occurs in what clients say (feedback), and what they do (behavior).

To complete the series, this blog on why asset managers should measure client behavior explains how humans are tricky creatures and why, therefore, you cannot rely fully on what they say. In contrast, actions speak louder than words. So, you should measure your effect on client behavior to focus your organization on what matters most (which is whether or not they buy, stay, or buy more), and what you can do to stimulate these behaviors. This makes actions, not words, the reliable indicator of demand and, therefore, it makes client behavior data the perfect business intelligence: meaningful, commercial, and professional.

The UK Investment Association’s FinTech hub (Engine) also featured this article here.

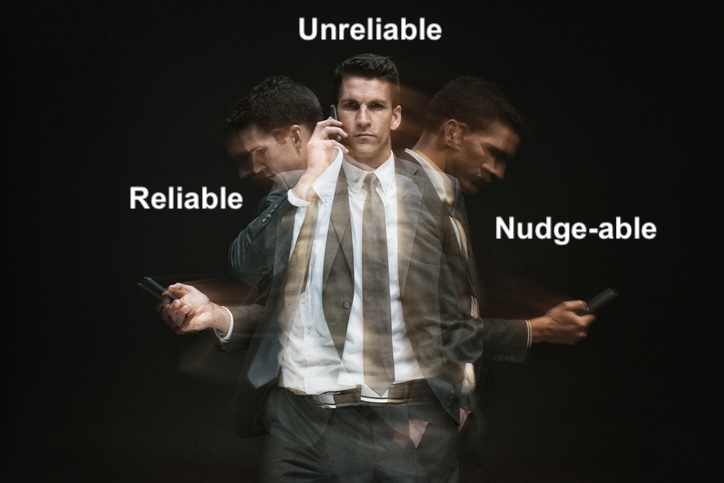

Reason 1: Humans are tricky creatures, so you cannot rely fully on what they say. 1,2,3

Memory bias and conflict-aversion – when our opinions are presented as facts, they can appear authoritative, but we should not forget that we, their source, are highly unreliable. We forget less recent events, we avoid difficult conversations (80% of client feedback reviews generate above-average ratings), and we say one thing but do another.

Clients have ‘survey fatigue’ – exacerbating the problem for institutional asset managers, your clients are inundated with potentially dozens of feedback requests from all their other managers, risking an ‘eye roll’ when yours arrives too and contributing to low response rates. So even though you are only sending one survey request, every other asset manager is doing it too, creating “survey fatigue”, and making your request part of the problem.

Questions of statistical validity, and lag times – low response rates are common across the investment industry and that creates an issue of statistical validity at the sub-sample level. So, while the colourful words of a few may not be representative of all, you risk a knee-jerk response to a skewed output. To compound the problem further, you can only ask for feedback infrequently, which gives you low-resolution data and lag times that further diminish its effectiveness. “If only I had known this sooner,” said the manager.

Inconsistent qualitative data – lastly, at its heart, client feedback is inconsistent qualitative data, (different clients have different definitions of ‘good’), that is often dressed up as quantitative data. But cosmetics cannot change substance.

Caveat emptor (buyer beware) – so, while we understand the importance of consulting clients, at Accomplish we recommend you not rely fully on feedback as your primary mechanism of evaluation and, when you do use it, be mindful that it will contain gaps and inaccuracies.

Reason 2: Nothing matters more than whether clients buy, stay, or buy more. These are actions, not words.

Nothing matters more – at Accomplish, we believe an organization’s most important capability is to get clients to buy, to stay, and to buy more. These are actions (behavior) and not words (feedback), so if you target them (e.g. sales conversion, client retention, and products per client) you will focus your organization on what matters most.

Behavior will give you a complete and comparable picture – in contrast to client feedback, behavior is universal and definable, which means you will create a complete and comparable picture. For example, X% of clients saying that, overall, they value your investment services more than your peers may make you feel nice, but watching them vote with their wallets as they give you a longer average client tenure than your peers will tell you a lot more and make you feel a lot better.

You already have access to behavioral data without disrupting clients – behavioral data is digitally available in high-resolution in your own systems. For example, before you hassle clients for their opinion on your investment thinking, examine their behavior and form your own hypothesis: if they spent longer than the industry average on your thought leadership, scrolled deeper and returned more frequently, it is a safe assumption that they value your investment thinking. If they also attended the associated event and requested follow-up meetings in greater numbers than your rivals, then the leading indicators imply that you should gear-up for a good sales period.

Unaffected by innate conflict-aversion and memory biases – you already have all the information needed for these analyses without disrupting your clients AND it is more accurate and more complete because behavioral data is unaffected by the innate human aversion to conflict and our propensity to forget things – you either won that pitch, or you didn’t.

Measurable over any timeframe – client behavior is also measurable over any timeframe, for example, client meetings that are a crucial leading indicator of sales, retention, and cross-selling. In the Client Behavior Benchmark, we compare meeting volumes quarterly, but many Distribution COOs also track this metric internally on a monthly basis.

Behavioral data is dollarizable – furthermore, the key client behaviors are dollarizable, which means you can quantify the revenue impact of your ability to get clients to buy (sales conversion), stay (client tenure), and buy more (products per client). Only with this information can you reliably calculate the ROI of a client-related initiative.

Perfect for business targets – all of this makes client behavior the perfect raw material for meaningful, commercial, and professional targets. Client behavior is definable, measurable, and observable, and through an industry-wide initiative Accomplish has defined the leading and lagging behavioral indicators that institutional asset managers will want to see their clients display. Client feedback targets? Not so much: being in the 80% that are supposedly above average will tell you little and risk complacency.

Reason 3: You have the power to stimulate behaviors in others. Use it, or don’t be surprised. 4,5

Anyone can nudge – the great thing about leading behavioral indicators is that you can stimulate them, because we all have the power to ‘nudge’ behaviors in those around us. Therefore, you should take precise and deliberate steps to keep your sales funnel as wide as possible for as long as possible. And including behavioral ‘nudges’ in your client journey will help you.

Immediate and positive reinforcement – nudging involves immediately and positively reinforcing one behavior by suggesting another incremental step forward that is likely to help them achieve their goal, e.g. “Enjoyed this investment event? Discuss its implications for your portfolio with our experts.”

Nudge them forward through your sales funnel – viewed through the lens of this behavioral nudge, the measure of an effective investment event shifts from absolute attendee volumes to the proportion who request a follow-up meeting. This keeps clients moving through your sales funnel from a ‘many-to-one’ general event to a ‘one-to-one’ specific discussion that could result in prospects buying, or existing clients staying and buying more.

Effective sales funnels are all about micro conversion rates – by employing this simple mechanism, you can convert one behavior (event attendance) into another more valuable one (a meeting request). These are micro conversion rates that also demonstrate the effectiveness of the interactions between the different teams in your organization – in this example, a ‘follow-up meeting-per-event ratio’ would indicate how well the events and relationship management teams are working together.

Putting this into practice – to put this into practice across your client journey, identify the leading behavioral indicators – email click-through rate, thought leadership visit length, event attendance, client meeting volumes, and RFP requests – and decide how you will stimulate them by converting one to another. When developing these strategies, remember your clients are normal humans that we describe in Reason 1 above: they have short attention spans and they need reminders, but they will respond to a nudge. Then present them with a logical, incremental, and immediate next step that will help you both achieve your goals.

Use the Client Behavior Benchmark to set informed targets

At Accomplish, we manage the asset management Client Behavior Benchmark that will help with all of this. Designed by an industry-wide innovation project, the benchmark lets you measure and compare your effect on institutional client behavior.

- See your out- and under-performance at stimulating client behavior vs regional colleagues and competitors.

- Run your institutional sales funnel and end-to-end client journey holistically – marketing, sales, service.

- Manage your effect on whether clients buy, stay, and buy more.

Typical buyers of the benchmark are those who shape distribution strategy: heads of Business Intelligence, Client Insights, Client Experience, Distribution COOs, and Marketing Directors. If this is you, check out the Client Behavior Benchmark and schedule a demo to see it in action.

This concludes a three-blog series on the advantages of behavioral benchmarking and how it is a welcome development for your clients and you. We hope you found this article useful. Here is the full set:

- Why asset managers should measure client experience.

- How leading asset managers are measuring client experience.

- Why asset managers should measure client behavior?

- FeldmanHall, et al, 2012. What we say and what we do: The relationship between real and hypothetical moral choices.

- Tversky and Kahneman, 1974. Judgment under uncertainty – heuristics and biases.

- Shafir, Simonson, and Tversky, 1993. Reason-based choice.

- Cooper, Heron, and Heward, 2020. Applied behavior analysis.

- Thaler and Sunstein, 2021. Nudge.