As we learned in an earlier blog in this series that answers the fundamental questions about client experience (CX), CX is a client’s overall impression of you as a supplier.

It is an effect in a client that a supplier (like an asset manager) causes. And it encompasses every direct and indirect interaction your firm has with its clients.

But, after decades without it, why asset management CX now?

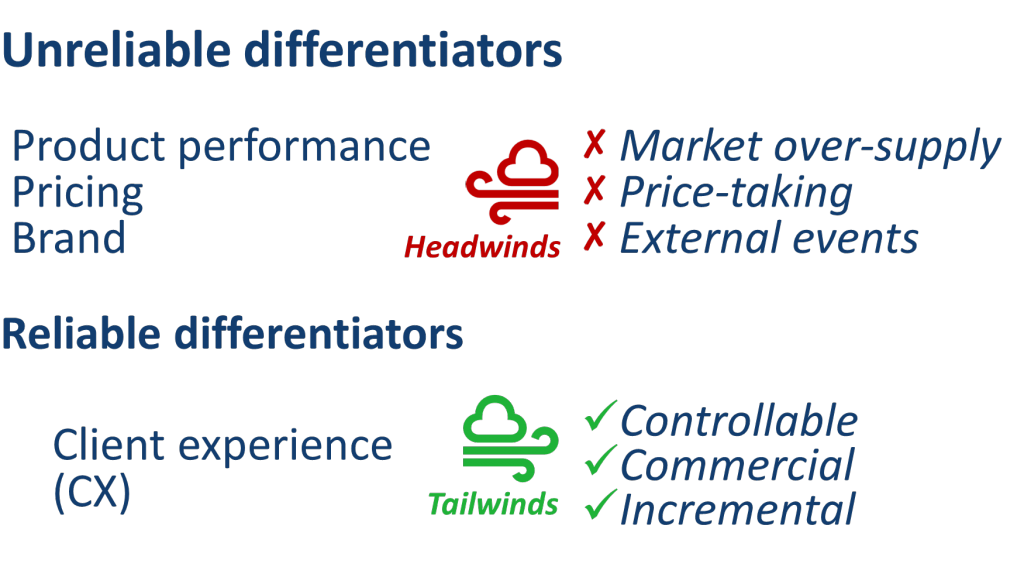

Survival requires differentiation, and the old ways have become unreliable

In previous decades, financial tides were rising and asset managers were able to adopt a ‘product-led’ business strategy, that is, develop a product and then look to sell it.

A knowledge imbalance gave fund managers the bargaining power, which resulted in high fees that, in turn, attracted new entrants to the market and caused a general proliferation of investment products.

More than once, clients found themselves on the wrong side of this and, blind to which fund manager would outperform in the future, they began to question whether the average product performance was worth the high fees it commanded.

Many substitute products entered the market that product proliferation had already largely commoditised.

New regulations variously targeted the product-led approach and further encouraged fee compression.

A steady drip of scandals eroded the reliability of brand as a strategic differentiator and, ultimately, too many fund managers chasing too few assets shifted bargaining power to clients. All the ingredients for a price war were in place.

Why asset management CX?

This is a familiar story about the forces of supply and demand and Accomplish is not the first to tell it.

We are re-telling it because business strategy must respond effectively: competitors can also reduce prices, slim down product ranges, and increase operational efficiency.

Therefore, necessary though they are, these responses will not solve the root cause of lost differentiation in an over-crowded market.

Once a firm has lost the ability to reliably differentiate itself by either the performance of its products, its pricing, or its brand, all that’s left is how it conducts itself, how it serves its clients, and how it leaves them feeling.

That’s CX.

Become client-led to address the root cause

Referring to the first two of the five stages we follow when adopting new innovations,[1] ‘innovator’ and ‘early adopter’ asset managers have identified the product-led culture as the root cause of lost differentiation, and they have been seizing competitive advantage by shifting to the client-led culture of CX.

This shift in mindset prioritises listening to clients, wanting what THEY want, and maintaining the necessary products and services to satisfy their changing needs.

Ultimately, it’s about staying relevant.

In pursuit of a reliable source of differentiation, client-led firms have realised that HOW they conduct themselves, HOW they serve their clients as suppliers of investment services, and HOW they leave them feeling is controllable, commercial, and incremental.

Furthermore, if you can control something you can design it to be efficient, reliable, and memorable. As we learned in a previous blog on ‘how CX works’, only the memorable gets shared and discussed. The rest gets forgotten.

Whether it is favourable or unfavourable, your firm will have a CX today. Applying a client-led mindset to it can transform it into an irreplicable experience for your clients. Your competitors’ inability to replicate it makes it a reliable source of differentiation.

This means that in the survival-of-the-fittest asset management market, CX has become THE differentiator: THE way to get noticed and retain clients’ confidence, satisfaction, and revenue.

Making the shift also changes the internal balance of power

These market conditions present a strategic opportunity to seize a competitive edge and, as the chair of the Asset Management CX Forum, Accomplish works with the firms who have already made this shift in mindset, and those who intend to make it.

From our vantage point, there appears to be a large proportion of firms that are not clear on what CX is and are surprised to learn that an increasing number of their competitors already have Heads of CX.

We don’t know for sure what is holding them back, but it may relate to internal balances of power and influence.

It’s not an easy message, but it must be possible (and also understandable) that some industry leaders who became powerful within the product-led way of doing things – potentially even because of it – may find it difficult to share some of their influence with their colleagues across the end-to-end client journey: sales, marketing, client services and operations.

Fundamentally, though, differentiation is about competition. And competition is about survival.

It is not a fad … CX is here to stay

As we explain in our blog on B2B CX, it is not just that market forces have created a temporary opportunity for CX.

At the same time, our broader society has shifted and we are now all digital consumers who are constantly exposed to CX in the business-to-consumer (B2C) setting:

- We crave convenience

- We want information at our finger-tips

- We live in the moment

- We share and discuss our experiences publicly

- We understand a lot more about data than we might think

As consumers of B2C services, this shift has taught us all what good CX looks like and we now notice its absence. Because of this (and despite important differences between B2C and B2B CX, B2C CX is driving our expectations of B2B CX.

This is a relatively recent development from within the last decade and, at Accomplish, we do not expect this trend to change or reverse.

We believe CX is here to stay.

Follow Accomplish on LinkedIn

In this blog, we have addressed the crucial question of “why asset management CX?”

The final blog of our series on the fundamentals of CX will explore what good B2B CX looks like for asset managers, how clients can receive a positive and memorable experience, and how asset managers can be financially and operationally stronger.

- What is CX? 🤷🏻♂️

- How does CX work? 🤷🏼♂️

- Is B2B CX really so complicated? 🤷🏾♀️

- Why asset management CX? And why now? 🤷🏼♂️

- What does good CX look like? 🤷🏻♂️

The discipline of B2B CX is still in its infancy in the asset management industry.

Accomplish is changing this by helping firms measure their CX capability, gauge their alignment with what clients want, create industry-level solutions for industry-wide problems, increase adoption colleague-by-colleague, and by helping them solve any specific problems they face.

If you found this article useful, follow Accomplish on LinkedIn where we contribute frequently to extending the leading edge of CX across the asset management industry.