In this article, we define three levels of client insights and describe the opportunity gained from exploiting each one. We go on to explain how this sort of business intelligence will separate winners from losers and how the data you need for it is already in your marketing and CRM systems. As a result, you can now be more discerning about paying a premium for client insights from an external provider’s black box.

From a behavioral perspective, the asset management sales funnel is NOT an inverted triangle. It is an hourglass of buying, staying, and buying more. While this may be news to some people, it is a fact and the reason why the 7 use cases of the Client Behavior Benchmark will separate winners from losers. To spread the word, this blog gives you a simple explanation of each use case. We see it as a survival guide for asset managers navigating the current market environment – and the client behavior data you need for it is literally sitting in your systems waiting to be extracted and exploited.

In September 2023, Accomplish unveiled the Client Behavior Benchmark at DCE Connect – the annual invite-only asset management client engagement conference for MDs and senior managers. In a keynote speech, Adam Grainger explained how to measure client engagement, demonstrated how the Client Behavior Benchmark is helping investment firms keep their sales funnel as wide as possible for as long as possible – and the data is already in your systems. On completion of the conference, attendees placed behavioral insights at the top of their list of 2024 investments.

Here’s a story asset managers can be proud of – a breakthrough in how the industry leverages behavioral science to improve investment client experience (CX). This innovation, the CX Benchmark, allows firms to tap into valuable client behavior data that’s already in their systems. If your firm isn’t part of the benchmark yet, now is the time to join. Take control of your client data, uncover powerful insights, and drive better engagement.

We are proud to announce that Accomplish has become a FinTech member of the UK Investment Association’s IA Engine. “The Engine identifies, develops, and accelerates firms with innovative solutions, facilitating adoption of technology” across the IA’s members that manage £9.4 trillion of assets.

In this video, Adam Grainger discusses with Gabriela Martins da Silva how asset managers are learning to keep their sales funnels wider than their competitors. To learn more, request an invitation to attend WBR’s upcoming Digital Client Engagement Connect event when Adam will give the keynote speech.

We are thrilled to announce that our Nurturing the Future project has hit its latest milestone – 5,000 trees planted! But where are all these trees? And why did we choose to support certain reforestation projects?

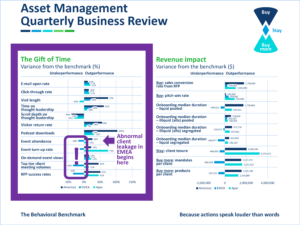

Accomplish is excited to announce new functionality in the Behavioral Benchmark. In trials, it let asset managers pinpoint abnormal institutional ‘client leakage’. We call it the ‘Gift of Time’ and firms are now using it to keep their sales funnels as wide as possible for as long as possible. In combination with the recent addition of quantifiable revenue impacts, the Gift of Time completes the benchmark’s contribution to asset managers’ quarterly business reviews.

We have rolled out new features to the Behavioral Benchmark. In this video Jonathan Attoh, data scientist, takes you through the key ones: new fields, customizable flags, and a dollarization feature that you can use in your ROI calculations.

What is the Behavioral Benchmark, how does it work, and what are asset managers doing with it? Discover the answers to these questions from Adam Grainger, Founder and MD of Accomplish. And if you attend TSAM London on 7 and 8 June 2023, visit the Accomplish stand to learn more.