In September 2023, Accomplish unveiled the Client Behavior Benchmark at DCE Connect – the annual invite-only asset management client engagement conference for MDs and senior managers. In a keynote speech, Adam Grainger explained how to measure client engagement, demonstrated how the Client Behavior Benchmark is helping investment firms keep their sales funnel as wide as possible for as long as possible – and the data is already in your systems. On completion of the conference, attendees placed behavioral insights at the top of their list of 2024 investments.

Here is a story asset managers can be proud of. It is the tale of how an industry-wide innovation initiative brought behavioral science to the discipline of investment client experience (CX). Because of it, you can now use the Client Behavior Benchmark to capitalise on the often over-looked client behavior data that’s already in your systems. If you are not already in the benchmark, in your interests and those of your clients, join in, take control of that data and exploit it.

We are proud to announce that Accomplish has become a FinTech member of the UK Investment Association’s IA Engine. “The Engine identifies, develops, and accelerates firms with innovative solutions, facilitating adoption of technology” across the IA’s members that manage £9.4 trillion of assets.

In this video, Adam Grainger discusses with Gabriela Martins da Silva how asset managers are learning to keep their sales funnels wider than their competitors. To learn more, request an invitation to attend WBR’s upcoming Digital Client Engagement Connect event when Adam will give the keynote speech.

We are thrilled to announce that our Nurturing the Future project has hit its latest milestone – 5,000 trees planted! But where are all these trees? And why did we choose to support certain reforestation projects?

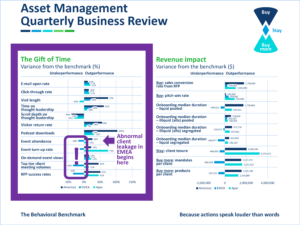

Accomplish is excited to announce new functionality in the Behavioral Benchmark. In trials, it let asset managers pinpoint abnormal institutional ‘client leakage’. We call it the ‘Gift of Time’ and firms are now using it to keep their sales funnels as wide as possible for as long as possible. In combination with the recent addition of quantifiable revenue impacts, the Gift of Time completes the benchmark’s contribution to asset managers’ quarterly business reviews.

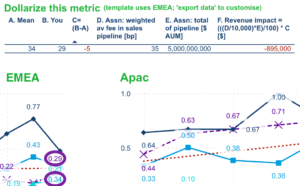

We have rolled out new features to the Behavioral Benchmark. In this video Jonathan Attoh, data scientist, takes you through the key ones: new fields, customizable flags, and a dollarization feature that you can use in your ROI calculations.

At Accomplish, we believe the asset management quarterly business review (QBR) will replace the annual distribution strategy because it lets you keep pace with the speed of change in today’s markets. To adapt more effectively than your competitors we believe your QBR needs to balance sufficient rigor with an ‘essentials-only’ approach. To achieve this, we propose a QBR template for institutional distribution professionals that incorporates vital lessons fighter pilots have learned about battling for supremacy in high-stakes situations. We hope you find it useful.

What is the Behavioral Benchmark, how does it work, and what are asset managers doing with it? Discover the answers to these questions from Adam Grainger, Founder and MD of Accomplish. And if you attend TSAM London on 7 and 8 June 2023, visit the Accomplish stand to learn more.

The big news is that the Behavioral Benchmark is now calculating the dollar impact of asset managers’ abilities to get institutional clients to buy, stay, and buy more. If, as the Financial Times has reported, “the golden decade is over” for asset managers, then you should exploit these strategic and dollarizable client behaviors to calculate the ROI of different distribution activities. This will keep you ahead of the competition and out of trouble.