What is the Behavioral Benchmark, how does it work, and what are asset managers doing with it? Discover the answers to these questions from Adam Grainger, Founder and MD of Accomplish. And if you attend TSAM London on 7 and 8 June 2023, visit the Accomplish stand to learn more.

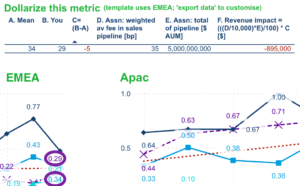

The big news is that the Behavioral Benchmark is now calculating the dollar impact of asset managers’ abilities to get institutional clients to buy, stay, and buy more. If, as the Financial Times has reported, “the golden decade is over” for asset managers, then you should exploit these strategic and dollarizable client behaviors to calculate the ROI of different distribution activities. This will keep you ahead of the competition and out of trouble.

The asset management sales funnel is an hourglass that comprises buying, staying, and buying more. This is important because a traditional sales funnel that only includes ‘buying’ would expose an asset manager to the risk of lower growth. The Behavioral Benchmark is now helping firms see where on this end-to-end sales funnel they out- and under-perform their peers. Click for more information about this upgrade.

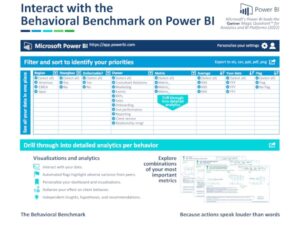

Staff in asset management firms are under renewed pressure to do more with less, yet they already had almost no spare bandwidth. Here are some real-world examples of 2022 efficiency initiatives that do not involve further cuts to bandwidth. This is the second blog in Accomplish’s two-part series on the ROI of business intelligence (BI).

See your end-to-end effect relative to peers on whether clients are buying, staying, or buying more. Identify your highest priorities, greatest strategic opportunities, and biggest challenges. And then drill down into specific metrics, interact with the data, and leverage independent expert interpretations.

We are pleased that ESG Investor has showcased our ESG client behaviors research. “As their sustainable investment priorities evolve, institutional and intermediary clients will increasingly grill asset managers”, displaying a greater prevalence of category 6 and 7 behaviors. Or, in plain English, fund managers should prepare for more challenge.

You always want average client tenure to go up, right? Wrong. As economic clouds gather, asset managers are focusing on how they will keep their clients. But, bluntly, your organization can only be half-serious about retaining clients unless it measures and interprets the age of their relationships. That’s where the Client Behavior Benchmark performs an essential function and, at Accomplish, we are pleased to share this 5-step framework for managing the dynamics of tenure data.

Here’s part 1 of a blog series on the ROI of BI – if you are involved in 2023 planning, you will need the best business intelligence (BI) and frequent updates in case you need to adjust your direction. And you will need it to deliver a return on investment (ROI) as you justify all spending. In this first blog, we present the asset management Behavioral Benchmark as the most cost-effective solution on the market.

Is your business intelligence (BI) fit-for-purpose? Client behavior is the reliable indicator of demand, which is why the Behavioral Benchmark is helping leading asset managers solve real-world problems, like how to get clients to buy, stay, and buy more. This case study explores ‘staying’ and ‘buying more’, and records an asset manager’s journey to being able to measure and compare demand in the real world.

Asset managers are now using new behavioral analytics capabilities to make science-based improvements to their client journeys. They are exploiting the Behavioral Benchmark to convert previously unavailable business intelligence into commercial value. Read on for lots of examples.