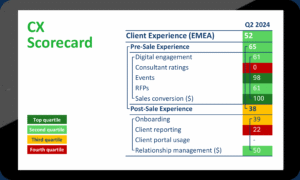

The asset management CX Scorecard gives you the board-level data and metrics needed to 1) track the effectiveness of client experience (CX) as a high-level differentiation strategy, 2) see your hot spots ‘at a glance,’ and if applicable 3) comply with the UK’s Consumer Duty.

We are proud to report that, in 2024, Accomplish’s Nurturing the Future project has continued to make strong progress, having now planted 8,000 trees! But where did we plant, and why? Click through to find out.

CX is an ‘effect’ you ‘cause’ that manifests itself in what clients say (feedback) and what they do (behavior). Feedback is qualitative while behavior is quantitative – measurable along the client journey in either ‘gifts of time’ or transfers of money. If your CX underperforms at engaging clients, they will give their time to your competitors … and then their money.

Read on for common pitfalls and best practices.

What is client experience (CX)? How does it work? And why should you care? These are the fundamentals of CX, but why should you care about the fundamentals of anything? Because of what we learn from Michael Jordan: “Get the fundamentals down, and the level of everything you do will go up.”

In a changing landscape in which only the most adaptable should expect to survive, Distribution Leadership Teams can use this blueprint to manage the contribution of their pre- and post-sales CX to their quarterly financial results.

The IAEngine is the UK Investment Association’s FinTech accelerator, and it was Accomplish’s privilege to be its featured FinTech across the month of April 2024. Thank you to Henry Bewley and the whole team at the IA Engine for showcasing the Client Behavior Benchmark. Watch the video to discover our answers to Henry’s three questions: 1) what does the Benchmark let asset managers do that they couldn’t do before, 2) how did this unique new capability come about, and 3) what should asset managers do now?

The UK’s Consumer Duty expects firms to “take behavioral biases into account” while ensuring they “avoid inappropriately manipulating them” and to have “Board-level data and metrics” to demonstrate compliance. Check out Accomplish’s playbooks for 7 behavioral biases you should incorporate into your sales funnel and the behavioral science behind a 5-level client retention strategy. Both guides cover best practices, mistakes to avoid, and metrics to monitor.

Actions speak louder than words, so asset managers should measure client behavior to focus their organization on what matters most (which is whether or not clients buy, stay, or buy more), and what you can do to stimulate client behavior. In contrast, humans are tricky creatures, so you cannot rely fully on what they say. This makes actions, not words, the reliable indicator of demand and, therefore, it makes client behavior data the perfect business intelligence: meaningful, commercial, and professional.

There are two types of client experience (CX) metric – leading and lagging ones – and this article focuses on the 3 lagging indicators. For the investment industry, they are ‘buying’ (sales conversion), ‘staying’ (client retention), and ‘buying more’ (products-per-client). These client behaviors involve transfers of money, which makes them dollarizable. They – and only they – pay the bills. If they point the wrong way for too long, the situation could become life-threatening for the organization, which makes them a vital component of asset management business intelligence.

In this article, we define three levels of client insights and describe the opportunity gained from exploiting each one. We go on to explain how this sort of business intelligence will separate winners from losers and how the data you need for it is already in your marketing and CRM systems. As a result, you can now be more discerning about paying a premium for client insights from an external provider’s black box.