Welcome to this series of blogs that will explore the advantages of behavioural benchmarking and how it is a positive step forward for all.

In this first article, we explore the fundamental question, ‘why measure client experience (CX)?’ and why, to manage it, you need to measure it.

As the series progresses, we will explain how CX is an ‘effect’ you ‘cause’ that occurs in two ways – in what clients say (feedback), and what they do (behaviour) – how you should measure both, and how leading firms are doing this. To conclude, we will discuss how you can leverage behavioural benchmarking to counteract the gaps and inaccuracies in feedback data, save time and effort, and alleviate clients ‘survey fatigue’.

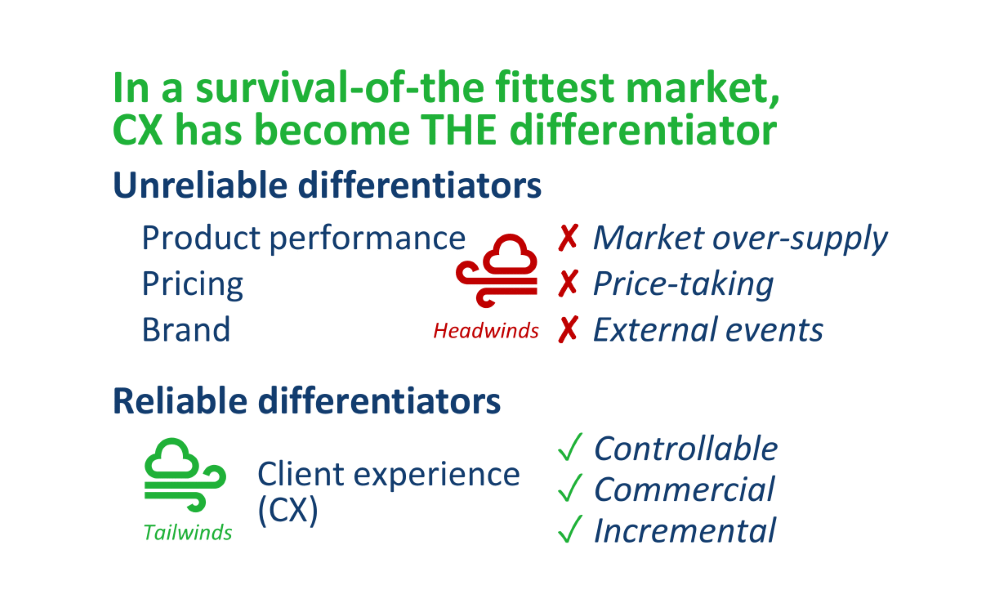

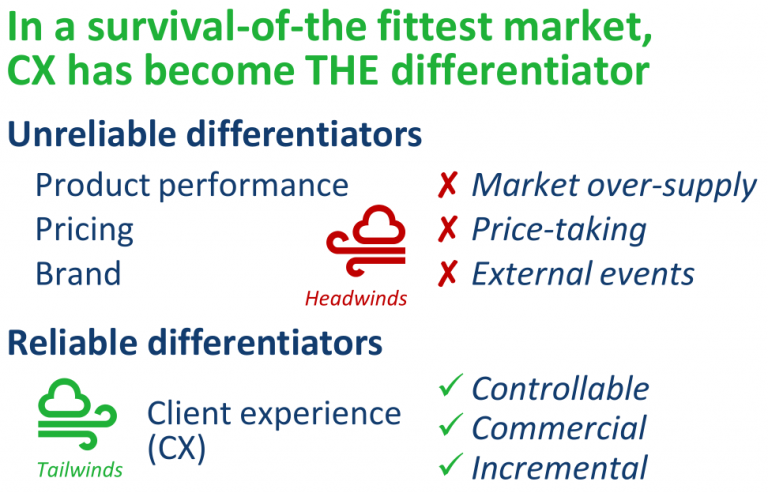

CX has become THE reliable differentiator

After decades without needing to care too much about CX, why is it now essential to most asset managers?

It is an accepted truth that asset managers are in a ‘survival-of-the-fittest’ market. But why?

The answer to both questions is because the long-term the forces of supply and demand have shifted the bargaining power to clients. Another outcome of these multi-decade trends is that the old ways asset managers differentiated themselves have become unreliable.

Survival requires differentiation. Yet, for the average firm, this shift in bargaining power means that they have lost their ability to differentiate themselves by either their investment performance, their pricing, or their brand.

For most firms, the only reliable differentiator that remains is how they conduct themselves, how they serve their clients, and how they leave them feeling. That’s CX, which means that, by default, CX has become THE reliable differentiator.

CX is here to stay

Over the same period, modern society digitised and we are all now constantly exposed to CX in the business-to-consumer (B2C) setting.

This has taught us what good experiences look and feel like and we now notice inferior ones. This means your clients’ experiences in the B2C economy are driving demand for CX from your B2B asset management firm.

This is a relatively recent development. We do not expect it to change or reverse. CX is here to stay.

Control what you can control

The good news about CX, along with its financial benefits, is that it is entirely within your control: whether it is favourable or unfavourable, your firm will be giving your clients an experience today.

Early adopter firms have seized the opportunity by designing efficient, reliable, and memorable client journeys. Through these transformations, the leading firms have developed irreplicable moments with their clients and harnessed CX as a reliable source of differentiation.

Across the industry, a healthy CX community now exists with networks such as the Asset Management CX Forum extending the leading edge with new insights and tools. Indeed, in Q2 2020, we found that 100% of asset managers were revising their overall business strategies in response to COVID-19 and that 68% expected CX to play an important role in the future.

Why measure client experience?

Asset managers should consider CX as part of their business strategy, especially those who have seen signs that they have lost traditional forms of differentiation, e.g. price drops across a range of investment strategies. If this applies to your firm, here are the three reasons why you should measure client experience:

- To manage the experience you give to clients – if CX is important to your firm, you will need to manage it actively. To do this, you should break it down into its constituent parts and use objective calculations to better understand it and where you should prioritise your efforts.

- To know your direction of travel – your first measurement will give you a baseline and subsequent observations will tell you whether you have improved or worsened, where, and by how much. You can then determine the effectiveness of the changes you made and allocate resources accurately in response.

- To understand whether you have stood out – fundamentally, differentiation is about competition and competition is about survival. This is not fluffy stuff. If you need to differentiate your firm through CX, you should use a standard unit of measure. This will enable you to compare yourself against others and determine whether you have stood out in the way you wished. For that, you need a benchmark built around a standard taxonomy, which is why we worked with a group of asset managers to build the Client Behavior Benchmark.

Follow Accomplish on LinkedIn

As a discipline, CX is still in its infancy. This is particularly the case in the context of B2B asset management. Accomplish is on a mission to change this with new tools that help asset managers stand-out from the crowd through the experience they give their clients.

This was the first blog in a 3-part series on the advantages of behavioural benchmarking and how it fills the gap in the asset management industry’s toolbox. In our next article, we will explain how firms at the leading edge of CX maturity are measuring CX.

If you found this content interesting and would like to stay in touch with the topic, follow Accomplish on LinkedIn where we will post the rest of the series and much more as we extend the leading edge of CX:

- Why measure client experience

- How leading asset managers are measuring client experience

- Why asset managers should benchmark client behaviour